Low VIX in current bullish phase implies market is close to top

)

The bull run continued as the European Central Bank (ECB) decided to cut rates and loosen up money supply. The indices hit new highs on Monday with the Nifty touching 8,180. The move was broad-based with Advances far outnumbering Declines. The FIIs increased their buying quanta and domestic retail sentiment is also strong.

The Nifty, Sensex, Junior, Bank Nifty, etc, all continue to trend upwards. Volumes are reasonable. The market continues to have bullish trends across all time-phases, (short-term, intermediate term, long-term) by definition, since it is logging higher highs.

In a run like this, it is impossible to set targets since the indices are all in new zones without any pricing history. The trend following technical trader will just set a trailing stop loss and stay long. However, the move has come so fast that any correction could be very steep. As a rule of thumb, day-traders should assume congestion will be visible at 50-point Nifty intervals.

Given that the market has moved by a significant amount, the VIX remains very low. This implies that the market is seriously under-pricing premiums on close to money Nifty options. This is classic behaviour close to market tops.

The Bank Nifty remains a key driver for any sustained trend. The financial index has broken through the 16,200 level. The futures are trading at premiums of close to 50 points above the spot index. The nearest support on a correction could be 15,975-16,000. Upside targets are difficult to call but 16,750 may be a possible target.

The market is happy with the ECB easing. The latest US payroll data and the official reaction has given most traders the impression that the Fed will not hike rates until 2015. Given high FII inflows the rupee could rise sharply, or the RBI may be forced into action to keep the rupee inside an acceptable band. The dollar could harden versus the Euro.

As mentioned above, September Nifty options premiums are low. The put-call ratios are in healthy zones. The three-month PCR is at 1.27 while the September PCR is just above 1.2. This implies market is not overbought despite the surge.

A look at the option chains does however indicate that traders don't think the market could go much higher in the short-term. The Nifty Call chain has massive open interest at September 8,200c and there's high OI through till 8,400c. The Put chain has a lot of OI down till 7500 with peak OI at 8,000p. Based on this, a short-term (say, three-session perspective) view implies the expectations are that the Nifty will not move outside of 8,000-8,400. However, if we're looking at the settlement, a move between 7,800 and 8,700 could be possible.

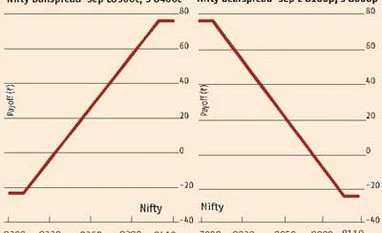

The spot Nifty index closed at 8,173 with the futures at 8192. A close-to-money bullspread of long Sep 8,200c (77) and short 8,300c (37) costs 40 and pays a maximum of 60. An in-the-money bearspread of long Sep 8,200p (86) and short 8,100p (49) costs 37 and has a maximum payoff of 63.

These are attractive because4 they are so close to money.

The bearspread is quite tempting with a good risk: reward ratio. A trader could go wider. A long 8,300c (37) and short 8,400c (14) costs 23 and pays a maximum 77 while a long 8,100p (49) and short 8,000p (22) costs 27. Combining these two spreads, we get a long 8,100p, long 8,300c, short 8,000p and short 8400c. This costs at maximum 44 and has a maximum payoff of 56 with breakevens at 8,056, 8,344.

The Nifty, Sensex, Junior, Bank Nifty, etc, all continue to trend upwards. Volumes are reasonable. The market continues to have bullish trends across all time-phases, (short-term, intermediate term, long-term) by definition, since it is logging higher highs.

In a run like this, it is impossible to set targets since the indices are all in new zones without any pricing history. The trend following technical trader will just set a trailing stop loss and stay long. However, the move has come so fast that any correction could be very steep. As a rule of thumb, day-traders should assume congestion will be visible at 50-point Nifty intervals.

Given that the market has moved by a significant amount, the VIX remains very low. This implies that the market is seriously under-pricing premiums on close to money Nifty options. This is classic behaviour close to market tops.

The Bank Nifty remains a key driver for any sustained trend. The financial index has broken through the 16,200 level. The futures are trading at premiums of close to 50 points above the spot index. The nearest support on a correction could be 15,975-16,000. Upside targets are difficult to call but 16,750 may be a possible target.

As mentioned above, September Nifty options premiums are low. The put-call ratios are in healthy zones. The three-month PCR is at 1.27 while the September PCR is just above 1.2. This implies market is not overbought despite the surge.

A look at the option chains does however indicate that traders don't think the market could go much higher in the short-term. The Nifty Call chain has massive open interest at September 8,200c and there's high OI through till 8,400c. The Put chain has a lot of OI down till 7500 with peak OI at 8,000p. Based on this, a short-term (say, three-session perspective) view implies the expectations are that the Nifty will not move outside of 8,000-8,400. However, if we're looking at the settlement, a move between 7,800 and 8,700 could be possible.

The spot Nifty index closed at 8,173 with the futures at 8192. A close-to-money bullspread of long Sep 8,200c (77) and short 8,300c (37) costs 40 and pays a maximum of 60. An in-the-money bearspread of long Sep 8,200p (86) and short 8,100p (49) costs 37 and has a maximum payoff of 63.

These are attractive because4 they are so close to money.

The bearspread is quite tempting with a good risk: reward ratio. A trader could go wider. A long 8,300c (37) and short 8,400c (14) costs 23 and pays a maximum 77 while a long 8,100p (49) and short 8,000p (22) costs 27. Combining these two spreads, we get a long 8,100p, long 8,300c, short 8,000p and short 8400c. This costs at maximum 44 and has a maximum payoff of 56 with breakevens at 8,056, 8,344.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Sep 08 2014 | 10:45 PM IST