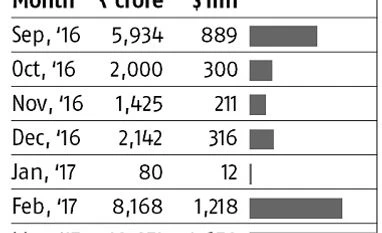

The central bank on June 7 said any company raising rupee-denominated bonds of over $50 million equivalent should issue those for a minimum maturity of five years. Also, the all-in cost of these bonds should be 300 basis points over the equivalent-maturity government bonds. According to RBI data, Indian companies raised Rs 33,165 crore through the masala bonds route till April.

The five-year government bond is now at about 6.55 per cent. This would mean if a company has to issue equivalent-maturity masala bonds, it can do so at 9.55 per cent. Considering better-rated firms raise the money at a much lower rate, at about 7-7.5 per cent, the ceiling should not be a problem. On the higher side, Adani Power raised Rs 500 crore through five-year bonds at 9.1 per cent.

There have been other issuers too who tapped the market for more than 10 per cent. These firms would be left out for good from the market. Most of these bonds in the past have raised money from the market through the private placement route.

According to the head of treasury of a foreign bank, investors in some of these firms could be the promoters themselves and this may have raised the RBI’s concerns. Although there are clear norms about who can invest in masala bonds, it might not be possible for the central bank to track the investors, considering the market is abroad. Technically, masala bonds are risk-free instruments for the issuers. Nevertheless, by virtue of these being an obligation for the country as a whole to pay up the due, the bonds increase the riskiness of the sovereign, said a rating agency executive. The central bank may have wanted to weed out the risky companies from piling on debt for the country, the executive said.

However, according to an investment banker with a foreign bank, who structures bond issuance for low-rated firms, clubbing ECB norms with masala bonds would disrupt the market and shut down a cheaper funding option for small and medium enterprises (SMEs).

“Indirectly, you are telling the SMEs that for all their financing needs, there is no other alternative than the bank loan market, no matter whatever the lending rates are,” said the investment banker, requesting anonymity, adding for better-rated firms, masala bonds were not necessary as they could raise money at the same rate from the domestic market.

)