Muted quarter for Gateway Distriparks, subsidiary listing a key trigger

Despite the muted March quarter show, most analysts continue to have a buy recommendation due to expected upsides from listing of the cold chain subsidiary

)

The Gateway Distriparks stock lost three per cent over the past two trading sessions on March quarter numbers that were marginally below expectations. Lower volumes brought on by a slowing export import business has impacted its key segments.

While consolidated revenues were flat on a year-on-year basis at Rs 267 crore, Ebitda increased 14.7 per cent due to operational gains at the rail freight division. Reported net profit was up 20 per cent to Rs 40 crore, largely due to lower taxes. After adjusting for tax reversal and prior period expenses, net profit growth was higher by 31 per cent y-o-y to Rs 44 crore, according to analysts at IDBI Capital.

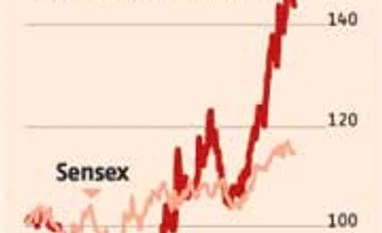

Despite the muted March quarter show, most analysts continue to have a buy recommendation due to expected upsides from listing of cold chain subsidiary Snowman and volume growth from expansion of its businesses and turnaround once global trade picks up. These hopes led to a sharp run-up in its stock price, up 37 per cent since March.

The stock trades at 13 times its FY15 earnings per share estimate of Rs 14. While the Bloomberg consensus target price of Rs 191 means an upside 10 per cent from current levels, given the gains in the last quarter, investors could look at the scrip on dips.

Rail business-led growth

Among its three businesses, the rail segment, its largest helped push up the consolidated performance of Gateway. Ebitda for this business was up 15 per cent y-o-y to Rs 32 crore, while margins were up over 340 basis points to 21.4 per cent. Moving out of the non-profitable short distance routes helped the segment improve its margins. The higher segment margins helped the overall consolidated margins improve by 130 bps to 26.6 per cent. The management, according to analysts at Sharekhan, believes the rail division will be able to hold on to margins despite tariff hikes due to higher share of the export-import trade, which has a faster turnaround time, and start of double-stacking operations.

The company's cold chain subsidiary reported a revenue growth of 30 per cent to Rs 44 crore led by capacity additions. However, higher interest and depreciation expenses dented segment net profit growth which fell 40 per cent to Rs 3.2 crore. The listing of this subsidiary continues to be the biggest trigger for the company.

Volume slowdown

Though operational performance improved, on the demand side, volumes across rail and container freight business fell on account of slowdown to the tune of two to five per cent year-on-year.

Revenues for the rail business, which account for half of Gateways consolidated income, was down about 1.8 per cent due to lower volumes, realisations too slipped three per cent. Volumes of container freight station segment which is the most profitable part of its three businesses fell on the back of a drop in import cargo. Realisations of this segment which accounts for 27 per cent of overall revenues were down seven per cent.

While consolidated revenues were flat on a year-on-year basis at Rs 267 crore, Ebitda increased 14.7 per cent due to operational gains at the rail freight division. Reported net profit was up 20 per cent to Rs 40 crore, largely due to lower taxes. After adjusting for tax reversal and prior period expenses, net profit growth was higher by 31 per cent y-o-y to Rs 44 crore, according to analysts at IDBI Capital.

Despite the muted March quarter show, most analysts continue to have a buy recommendation due to expected upsides from listing of cold chain subsidiary Snowman and volume growth from expansion of its businesses and turnaround once global trade picks up. These hopes led to a sharp run-up in its stock price, up 37 per cent since March.

The stock trades at 13 times its FY15 earnings per share estimate of Rs 14. While the Bloomberg consensus target price of Rs 191 means an upside 10 per cent from current levels, given the gains in the last quarter, investors could look at the scrip on dips.

Rail business-led growth

Among its three businesses, the rail segment, its largest helped push up the consolidated performance of Gateway. Ebitda for this business was up 15 per cent y-o-y to Rs 32 crore, while margins were up over 340 basis points to 21.4 per cent. Moving out of the non-profitable short distance routes helped the segment improve its margins. The higher segment margins helped the overall consolidated margins improve by 130 bps to 26.6 per cent. The management, according to analysts at Sharekhan, believes the rail division will be able to hold on to margins despite tariff hikes due to higher share of the export-import trade, which has a faster turnaround time, and start of double-stacking operations.

The company's cold chain subsidiary reported a revenue growth of 30 per cent to Rs 44 crore led by capacity additions. However, higher interest and depreciation expenses dented segment net profit growth which fell 40 per cent to Rs 3.2 crore. The listing of this subsidiary continues to be the biggest trigger for the company.

Volume slowdown

Revenues for the rail business, which account for half of Gateways consolidated income, was down about 1.8 per cent due to lower volumes, realisations too slipped three per cent. Volumes of container freight station segment which is the most profitable part of its three businesses fell on the back of a drop in import cargo. Realisations of this segment which accounts for 27 per cent of overall revenues were down seven per cent.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: May 05 2014 | 10:44 PM IST