Nifty likely to see a period of consolidation

)

The market has settled a little after the violent fluctuations through the elections. The Nifty continued to make net gains despite a couple of minor corrections. Trading was narrowly ranged on Tuesday. But the undertone remains strong, with good breadth signals and volumes.

The Nifty has tested resistance at 7,500 unsuccessfully. It looks likely to see a period of consolidation and range-trading (7,200-7,500) as sanity returns. On the upside, the trader should watch for moves beyond the all-time high of 7,563 and, on the downside, a move below 7,100 could spark an intermediate correction. The settlement day is likely to see narrow ranging. The Nifty closed at 7,330 on Wednesday and a long May 7,300p was traded at 14 while the May 7,400c at six. Break-evens on a long strangle would be at 7,280 and 7,420. Any moves outside this range on settlement could trigger chaos. Most technical systems would advocate staying long, with a deep stop-loss at 7,100. The market is overbought but it is also in a strong trend where it can remain so indefinitely.

The Nifty's May put-call ratio is at 0.9 and the three month PCR is 0.93. PCR is not a great indicator close to settlement.

On the downside, the market has managed to stay above 7,250 in the last week. That could be taken as the first critical support. The 200-DMA is below current levels; so, useless as a trend-following indicator.

Domestic institution investors (DIIs) still seem to be looking to sell into a rising market though retail and foreign institutional investors (FIIs) are apparently positive. There has been massive profit booking when the Nifty has gone above 7,400. Premiums should ease in June as the market gradually normalises and starts tracking economic data. Overall, the rupee rise seems to be driving trading patterns to some extent. Information technology bounced at month-end. If the pattern holds, the Reserve Bank will probably buy dollars whenever the rupee hardens to Rs 58.00-58.50 a dollar.

The Bank Nifty has hit highs at 15,740. It could be crucial to the trend of the next few days. It looks mildly bullish and a June bullspread of long 15,500c (330) and short 16,000c (170) has a decent risk:reward ratio and is tempting.

The distribution of open interest across the June Nifty option chains makes a move of anywhere between 7000 and 7800 possible. If DIIs turn net buyers and FIIs maintain a bullish stance, the market will be forced up sharply. The reverse could lead to correction.

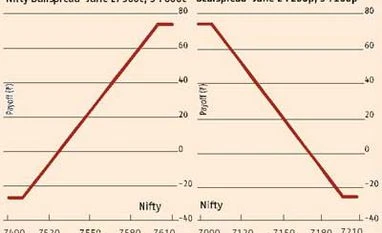

Premiums for June are fairly high but the risk-reward ratios are okay. A long June 7,300p (104) and short 7,200c (71) costs 33 and pays a maximum 67. A long May 7,400c (107) and a short 7,500c (68) costs 39 and pays a maximum 61. Both risk:reward ratios are reasonable. But the trader can move further away, given the start of a new settlement and the promise of fairly large moves in June.

A long 7,500c (68) and short 7,600c (41) costs 27 and pays 73, while a long 7,200p (73) and short 7,100p (48) costs 25 and pays 75. These are roughly equidistant from money, 150 points away. Combining these gives a spread with a cost of 52 and break-evens at 7,098 and 7,552.

The Nifty has tested resistance at 7,500 unsuccessfully. It looks likely to see a period of consolidation and range-trading (7,200-7,500) as sanity returns. On the upside, the trader should watch for moves beyond the all-time high of 7,563 and, on the downside, a move below 7,100 could spark an intermediate correction. The settlement day is likely to see narrow ranging. The Nifty closed at 7,330 on Wednesday and a long May 7,300p was traded at 14 while the May 7,400c at six. Break-evens on a long strangle would be at 7,280 and 7,420. Any moves outside this range on settlement could trigger chaos. Most technical systems would advocate staying long, with a deep stop-loss at 7,100. The market is overbought but it is also in a strong trend where it can remain so indefinitely.

The Nifty's May put-call ratio is at 0.9 and the three month PCR is 0.93. PCR is not a great indicator close to settlement.

On the downside, the market has managed to stay above 7,250 in the last week. That could be taken as the first critical support. The 200-DMA is below current levels; so, useless as a trend-following indicator.

Domestic institution investors (DIIs) still seem to be looking to sell into a rising market though retail and foreign institutional investors (FIIs) are apparently positive. There has been massive profit booking when the Nifty has gone above 7,400. Premiums should ease in June as the market gradually normalises and starts tracking economic data. Overall, the rupee rise seems to be driving trading patterns to some extent. Information technology bounced at month-end. If the pattern holds, the Reserve Bank will probably buy dollars whenever the rupee hardens to Rs 58.00-58.50 a dollar.

The distribution of open interest across the June Nifty option chains makes a move of anywhere between 7000 and 7800 possible. If DIIs turn net buyers and FIIs maintain a bullish stance, the market will be forced up sharply. The reverse could lead to correction.

Premiums for June are fairly high but the risk-reward ratios are okay. A long June 7,300p (104) and short 7,200c (71) costs 33 and pays a maximum 67. A long May 7,400c (107) and a short 7,500c (68) costs 39 and pays a maximum 61. Both risk:reward ratios are reasonable. But the trader can move further away, given the start of a new settlement and the promise of fairly large moves in June.

A long 7,500c (68) and short 7,600c (41) costs 27 and pays 73, while a long 7,200p (73) and short 7,100p (48) costs 25 and pays 75. These are roughly equidistant from money, 150 points away. Combining these gives a spread with a cost of 52 and break-evens at 7,098 and 7,552.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: May 28 2014 | 10:44 PM IST