Rupee closes at 69.85 a dollar after 3 months of weak run in the 70s

Sensex, Nifty close at highest levels since Oct 1; crude oil prices recover after early loss

)

premium

Last Updated : Nov 30 2018 | 10:19 AM IST

In a sign that the rupee’s new-found strength could stay for a while, exporters on Thursday were seen selling dollars after the domestic currency strengthened below 70 a dollar level, buoyed by a bullish stock market.

It is also clear that the rupee’s fortunes are intrinsically linked to oil prices. The recent drop in oil prices – from $83 to below $60 a barrel now – may have saved India at least $30 billion in oil bills, said experts. India imports about 1.2 billion barrels of oil every year.

On Thursday, oil prices bounced back, erasing an early loss, after industry sources said Russia had accepted the need to cut production, together with the Organization of the Petroleum Exporting Countries (Opec) ahead of its meeting next week. Brent crude oil was trading at $59.24 a barrel around 10 pm (IST). Brent Crude prices have fallen about 30 per cent in the past two months.

The partially convertible currency strengthened more than 1 per cent from its previous close of 70.61 a dollar to end the day at 69.85. The rupee had strengthened as much as 69.78 a dollar in intra-day trade.

The Indian markets posted their biggest jump in nearly a month after US Federal Reserve Chairman Jerome Powell’s comments boosted investor sentiment. Powell said on Wednesday the US policy rates were “just below” neutral. The dovish tone saw the dollar weakening and emerging market assets gaining. Investors lapped up risky assets on optimism that the US central bank would halt raising interest rates next year.

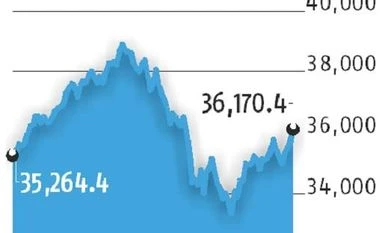

The Sensex gained 453.5 points, or 1.3 per cent, to close at 36,170, while the Nifty 50 index rose 130 points, or 1.21 per cent, to 10,859. Both indices closed at their highest levels since October 1. Most global markets also rallied, tracking a 612-point, or 2.5 per cent, jump in the Dow Jones index of the US on Wednesday night. The Sensex and the Nifty have rebounded nearly 8.5 per cent from their October lows. The indices, however, are still 7.5 per cent below their lifetime highs touched on August 29. Both benchmark indices and the rupee gained the most since November 2.

The benchmark 10-year government bond yield touched 7.61 per cent, the lowest level since May 5.

Currency dealers said the Reserve Bank of India (RBI) might have bought some dollars to recoup its reserves, while exporters were heavy sellers of the greenback. Some losses were triggered too due to the sharp movement of the rupee. The rupee has appreciated 5.15 per cent against the dollar in a month and is one of the best performing currency in Asia in November. However, year-to-date it is still down 8.56 per cent, making it one of the worst performing among major Asian currencies.

However, the rupee’s recent run against the dollar is making analysts pencil in a different view about the local currency now. For example, ICICI Bank, which was thinking the rupee would be at 70 a dollar in March, on Wednesday said it expected the levels to be reached much earlier, which happened on Thursday itself.

“We see the USD/INR pair trading in 70.00-72.50 range over the remainder of 2018 with a prospect of an undershoot towards 69.50,” ICICI Bank said in its report. “We are also lowering our projections for March 2019 with an equilibrium range of 69-71 likely for the period,” it said.

“These are good levels for importers to cover their positions,” said Ananth Narayan, associate professor (finance) at S P Jain Institute of Management & Research.

“A slowing US economy without global disruptions will result in a relatively weak dollar and provide respite for EM currencies, especially the ones with improving growth outlook. India continues to be the fastest growing large economy in the world, but slowing global demand and sharp earnings downgrade since the beginning of FY19 have created uncertainty on the growth outlook,” said Vinod Karki, vice-president, strategy, ICICI Securities.

But it is better for the importers to cover now, rather than waiting, warned Samir Lodha, managing director of QuantArt Markets Solution, a treasury consultant.

“We believe the three factors to impact the rupee in the coming two weeks would be the US-China meeting on November 30-December 1, an Opec meeting on December 6, and the Indian Assembly election results on 11th. These three could overall be rupee negative,” said Lodha.

“INR stability is unlikely to sustain for long and the exchange rate may move towards 73-74 a dollar. So go slow on export hedging and fast on import hedging,” Lodha said.

Thursday was also the expiration day for the November series derivatives contracts. The Nifty soared 7.4 per cent during the November series, its best monthly performance since March 2016.

Both domestic as well as foreign investors were net buyers on Thursday, with the former pumping in Rs 9.7 billion and the latter buying shares worth Rs 8.2 billion.

“A Fed pause, weaker USD and softer oil prices reduce external pressures for emerging markets – a reversal of 2018,” said Morgan Stanley economists Chetan Ahya and Nora Wassermann in a note. “Developed markets will slow but emerging markets will hold up well, supported by a favourable policy mix.”