Spectacular rise in MF assets

)

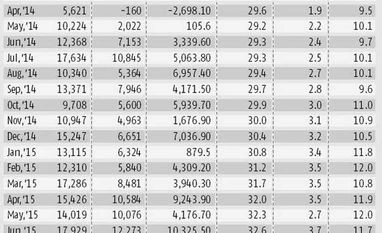

The domestic mutual fund sector has added about Rs 5 lakh crore of assets since March 2014. Assets under management have risen 60 per cent to over Rs 13 lakh crore in July. This has been a resurrection of sorts for the sector, as it had hit a downward spiral following the 2008 financial market meltdown.

Several regulatory interventions, weak market sentiment and poor returns had taken a toll. However, in the past 18 months, the sector has witnessed a sharp "U". It has managed to attract retail investors. Thanks to which the sector has seen record inflows in the equity segment.

Meanwhile, the proportion of equity assets has improved from 23 per cent to 30 per cent. Gross sales have surpassed Rs 2 lakh crore in the equity segment, while net inflows have remained decisively in positive territory. Robust inflows have seen the sector emerge as a strong buyer in the market. The number of investors' accounts (folios) in the equity category has risen by 3.6 million and more are being added.

Sectoral players are aiming to reach asset size of Rs 20 lakh crore by 2020. But given the pace of growth in the past one year, it appears the sector can go much farther than their set target.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 10 2015 | 12:31 AM IST