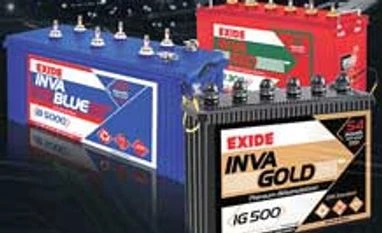

Temporary blip for Exide, Amara Raja

Amara Raja and Exide Industries' operating profit margins could fall only a bit on increase in lead prices

)

Share prices of battery makers Exide Industries and Amara Raja Batteries are down eight per cent on demand concerns following note ban and higher lead prices, which over the last two months are up 25 per cent compared to June quarter. Lead is a key raw material in batteries.

In the case of Exide, lead accounts for 80 per cent of raw material costs and 50 per cent of revenues. Analysts at Citi Research indicate that every one per cent increase in lead prices could impact the company’s earnings (net profit) per share by three per cent. For the quarter ended September, lead prices were up 12 per cent from last year and nine per cent from last quarter. Part of the impact is being passed on to clients: Exide increased prices in November by three per cent and Amara Raja by four per cent in the replacement market. Sales to original equipment makers will not be affected, thanks to a pass-through clause for costs that binds both transacting parties.

Exide eased raw material pressure in September quarter by reducing costs and having a favourable product mix. But analysts at UBS believe these benefits will get more than negated by higher lead prices and strong competition from Amara Raja, leading to a reduced pricing premium. Operating profit margin for FY18, according to them, will fall 50 basis points over their FY17 estimate of 15.1 per cent. While the two companies have taken price hikes, more are needed to maintain operating profit margins, believe analysts.

Meanwhile, the impact of note ban is seen as limited, shown by the lower fall in stock prices as compared to original equipment makers, to which Exide is a supplier. Original equipment makers for automobiles account for 20 per cent revenues of battery makers; also, they don’t deal in cash. But replacement sales, 40 per cent of revenues, could get hit following cash crunch from note ban. The industrial segment accounts for another 40 per cent of revenues. Citi analysts say since battery is a necessity, replacement sales are unlikely to get affected over a longer period.

In medium term, the two key factors favouring Exide Industries and Amara Raja are demand shift from unorganised to organised battery players due to rollout of goods and services tax (GST) and note ban. With auto demand expected to revive and replacement sales seen as robust, analysts foresee yearly revenue growth of 10-15 per cent over the next two to three years.

Steady growth in core business and value unlocking from insurance subsidiary are triggers for Exide. In Amara’s case, market share gains across auto, exports, and new segments are expected to lift fortunes. And considering the recent fall, analysts are not worried. At current price, Exide trades at 22 per cent valuation discount to Amara. Given the companies’ continued dominance in the market, both their stocks should do well once GST kicks in.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 08 2016 | 11:28 PM IST