Govt price controls affect GSK Pharma's results

Company will have to improve volumes, cut costs to overcome impact of lower pricing

)

GlaxoSmithKline (GSK) Pharmaceuticals' performance for the June quarter failed to impress the Street, with the stock shedding six per cent in two sessions. Unlike the double-digit growth in the preceding two quarters, the performance was below par. Its sales at Rs 685 crore grew eight per cent year-on-year (y-o-y), but flat sequentially, and lower than the expected Rs 700 crore. Net sales growth of the pharmaceutical business, 8.5 per cent, during the quarter included a four per cent growth from the vaccines business acquired from Novartis India. GSK said sales and net profit were hit by the government's price cuts.

The operating profit at Rs 90.3 crore was lower than the estimated Rs 170 crore. Thus, margins came at 10.2 per cent versus 16.7 per cent a year ago. The operating performance, apart from price cuts, was hit by other expenses (up 20 per cent y-o-y).

The Rs 1.82-crore exceptional gains from land sale were not enough to offset 40 per cent y-o-y decline in other income (down by Rs 16 crore). Net profit at Rs 72.3 crore declined 23 per cent y-o-y and 31 per cent sequentially. This was lower than the estimates of Rs 130 crore.

The government had revised/fixed ceiling prices of various scheduled formulations under Drug Price Control Orders. The company's brands such as antibiotic Augmentin and anti-allergic Cetzine have seen a major impact. Analysts at Religare Institutional Equities said Augmentin could see an impact of Rs 40 crore or a 20 per cent price cut in FY17 due to the revised ceiling price.

Analysts at Nomura had said the company's strategy of raising volumes by reducing prices substantially in key products such as Synflorix and Seretide was not margin-accretive and, hence, they expected earnings before interest, taxes, depreciation, and amortisation (Ebitda) margin to decline 23 basis points (bps) in FY17. The revival in Ebitda margin to 22 per cent, they say, could happen in FY19 driven by improvement in volumes, new introductions, increased output, and a leash on costs.

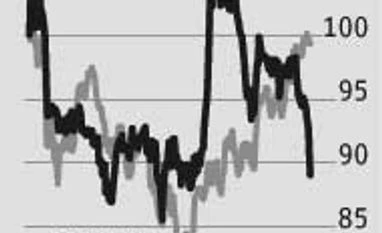

While experts see challenges for near-term profit prospects, the stock continues to trade at expensive valuations on expectations of a buyback. Brokerages Angel Broking and Motilal Oswal Securities have a neutral rating on the stock, while Karvy Broking and Nomura Research have sell ratings. Analysts at Motilal Oswal Securities after results said current valuations at 64x FY17E and 48x FY18E were on the higher side of historical valuations.

The operating profit at Rs 90.3 crore was lower than the estimated Rs 170 crore. Thus, margins came at 10.2 per cent versus 16.7 per cent a year ago. The operating performance, apart from price cuts, was hit by other expenses (up 20 per cent y-o-y).

The government had revised/fixed ceiling prices of various scheduled formulations under Drug Price Control Orders. The company's brands such as antibiotic Augmentin and anti-allergic Cetzine have seen a major impact. Analysts at Religare Institutional Equities said Augmentin could see an impact of Rs 40 crore or a 20 per cent price cut in FY17 due to the revised ceiling price.

Analysts at Nomura had said the company's strategy of raising volumes by reducing prices substantially in key products such as Synflorix and Seretide was not margin-accretive and, hence, they expected earnings before interest, taxes, depreciation, and amortisation (Ebitda) margin to decline 23 basis points (bps) in FY17. The revival in Ebitda margin to 22 per cent, they say, could happen in FY19 driven by improvement in volumes, new introductions, increased output, and a leash on costs.

While experts see challenges for near-term profit prospects, the stock continues to trade at expensive valuations on expectations of a buyback. Brokerages Angel Broking and Motilal Oswal Securities have a neutral rating on the stock, while Karvy Broking and Nomura Research have sell ratings. Analysts at Motilal Oswal Securities after results said current valuations at 64x FY17E and 48x FY18E were on the higher side of historical valuations.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 02 2016 | 9:36 PM IST