Dr Lal PathLabs stock has gained about nine per cent over the past fortnight, on brokerage recommendations and on buying after share fall due to demonetisation-related demand worries. While the company had a strong September quarter on high seasonal demand and a jump in volumes, the second half of this financial year is expected to be muted, given gradual recovery in sales volumes.

Analysts had cut their FY17 earnings estimates by 15 per cent due to sluggish second half. In fact, for the December quarter, the company is expected to post a sequential decline of 14 per cent in revenues and 23 per cent in operating (underlying) profit and 25 per cent in net profit. The higher impact on profits is due to pressure on sales volumes from preventive health care, which has higher realisation. Sales volumes are expected to improve from the March quarter.

Analysts at JM Financial are bullish over the company's prospects, given its strong brand equity, asset-light model, and a rapid expansion of the organised market, which is growing at 20 per cent. Given the expansion plans and market share gains, the company is expected to post revenue and operating profit growth of 20 per cent each annually over FY16-20. Diagnostics is different from pharma (generic) and health care (hospitals) in that the last two face regulatory, pricing, and high spending hurdles, which lead to uncertainty, lower revenue expectations, and lower return ratios.

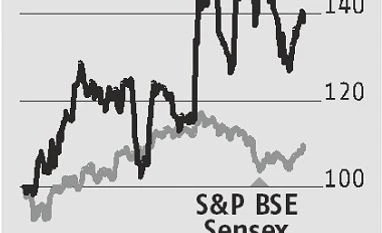

Diagnostics, on the other hand, faces less competition. This has helped the company not only grow its revenues and profits by 27-35 per cent in the past five years but also post healthy cash flows. Given the growth prospects of the company and the sector, it is not surprising the Street is valuing it at 28 times its FY18 enterprise value to operating profit estimates. This is at a 16 per cent premium to its diagnostics peer Thyrocare, and the premium is nearly double that of health care and pharma names. Given the target prices, which are at Rs 1,250 levels, there is a 13 per cent potential gain from the current prices. While the fundamentals are strong, investors can look at better entry points and hold on to the stock over longer periods.

)