Soumya Kanti Ghosh: India's rating upgrade an uphill climb

With the benefit of hindsight, it seems that the agencies adopt different criteria while evaluating different countries as is evident from the changes in ratings of developed and developing countries

)

India’s sovereign rating is currently at BBB- (Standard & Poor’s/Fitch) and Baa3 (Moody’s). In the next couple of months rating agencies may take a hard look at India’s sovereign ratings. With Q4 FY16 gross domestic product (GDP) numbers at 7.9 per cent, consumption growth picking up, fiscal deficit at 3.5 per cent and current account deficit at less than one per cent, the markets now believe the worst is behind us. Obviously as a logical corollary, nothing will be sweeter, if all this is followed by a rating upgrade in the second half of this fiscal.

But hold on, there is an unknown known of this entire ratings exercise that every one of us, including the government, needs to know.

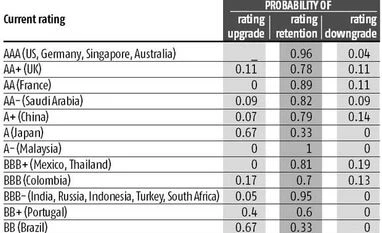

We did a detailed analysis of the foreign currency long-term sovereign ratings given by three major rating agencies, namely S&P, Moody’s and Fitch, for a group of 20 countries for the decade ended 2015. According to the World Bank classification, we further classified these countries into two equal groups, high income and middle income (GDP 2014). For these countries we constructed a rating migration matrix for the entire period.

The concept of rating migration matrix forms the fulcrum of any rating exercise. The rating agencies perform this exercise for companies to understand rating upgrades and downgrades and use it as a harbinger of economic activity. In a similar vein, for each agency we constructed a rating migration matrix that summarised changes in sovereign credit ratings over our given time horizon across different rating grades. Subsequently, we analysed the most conservative matrix giving the maximum probability of retaining the original rating. The idea was to understand how liberal rating agencies are in terms of rating upgrades and downgrades.

Here are the results. It was found that the countries with the highest rating (AAA) have the greatest probability of retaining the same rating (96 per cent), even though these have witnessed considerable turmoil during 2006-2015. Developed nations fall into this category and it seems that in the absence of creation of new havens of certainty, the rating agencies have kept their rating constant so that the system is not destabilised further. This could be the aftermath of severe criticism these agencies faced for adding fuel to the fire when they rapidly downgraded Eurozone countries owing to the Euro debt crisis.

The other developed nations are also rated highly (AA+ to AA-) and there is almost an equal chance of an upgrade or downgrade for these. However, the probability of retaining the same ranking is still at the higher end here as well.

Now comes the intriguing part. Despite all the brouhaha regarding the emerging economies in the public domain (countries in the range A- to BB+) the ratings have not changed much. These countries have remained in the same category for a very long period even though their macroeconomic performance has improved over time. A case in point is India, which has remained stuck in BBB- category despite its better performance relative to other emerging market economies. India’s growth was affected during the global crisis of 2008 but the economy showed resilience and recovered soon after. Since 1992, on a net basis (upgrades adjusted for downgrades) India has witnessed only a solitary rating upgrade.

If we look at the table, India has been treated unfairly in terms of sovereign ratings movements. Following S&P, in 1998 India was downgraded from BB+ to BB even as growth rate was high by as much as 200 basis points (Pokhran blasts may have been the reason?). This in itself was a rating aberration, for as per our estimates, there is a nil probability of rating downgrade in BB+ category. Subsequently, India was upgraded to BB+ in 2005 and BBB- in 2007. These were not entirely unexpected as the probability of rating upgrades is significantly high in these classes.

Another interesting finding is that the countries at the lower end (BB to B+) have a relatively higher probability of migration, that too to an upper rating grade. This shows these countries are improving in terms of their ratings. But it could be conjectured that once they hit the middle of the ratings bracket, their ratings could stagnate.

This particular finding has direct connotation for India. India is currently in the BBB- rating class that has only a five per cent probability of a rating upgrade. Even if we assume that India is fortunate enough to find itself in five per cent, it moves up to BBB. In BBB, however there is a 17 per cent probability of moving to the BBB+ class. In BBB+, the chance of rating upgrade is nil. Hence, India can at best hope to move into the BBB+ category and remain so thereafter. On the downside, there is also a significantly higher probability of rating downgrade in BBB+ and BBB classes. The only good thing is that based on our rating transition results, India has almost no chance of rating downgrade from current levels.

With the benefit of hindsight, it seems that the rating agencies adopt different criteria while rating a country as is evident from the changes in ratings of developed and developing countries. While the developed countries have occupied the top notches and hardly seen any downgrades despite slippage in macros, the developing countries have witnessed larger number of downgrades accompanied by fewer upgrades and that too in the lowest brackets.

An anecdote before we end. Rating agencies are still procrastinating about the ongoing economic recovery this fiscal. This is borne out by their rather conservative macro analysis reports and public interactions. Is it to predate a rating upgrade soon for India? Only time can tell.

(Co-authored by Disha Kheterpal & Shambhavi Sharma, economists, SBI)

The author is chief economic advisor, State Bank of India. Views are personal

Disclaimer: These are personal views of the writer. They do not necessarily reflect the opinion of www.business-standard.com or the Business Standard newspaper

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 13 2016 | 9:46 PM IST