Tobacco dependence again hits ITC ratings

With 20% revenues from FMCG, however, hope floats for future

)

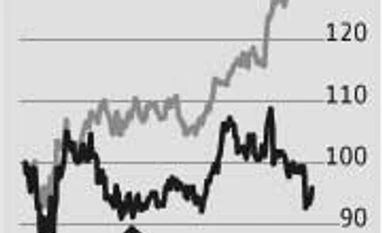

Fearing a disruptive tax regime for cigarettes, the market has re-rated shares of ITC. While the stock has fallen 12 per cent over the last month and a half, its multiples have compressed over the past year. ITC has underperformed the Sensex by 35 per cent over the past 12 months and trades at price/earnings multiple of 22x its FY16 earnings, compared to the FMCG sector's 25x. While a punitive tax regime would lead to further underperformance, a section of the market believes the firm's consumer, paper and agri businesses would compensate for the decline in profitability in the cigarette business.

ITC's FMCG business has attained significant scale over the past 10 years, with its share rising to 20 per cent of ITC's total revenues in FY14 from one per cent in 2002. The FMCG business has grown from Rs 70 crore in 2002 to Rs 10,400 crore in 2014. The growth trajectory of ITC's FMCG business is higher than any other FMCG company, say analysts. Says Nomura: "The company's performance in the FMCG business over the past 10 years gives us confidence that over the next five years, not only will the segment continue to deliver market-leading revenue growth, but profitability is also likely to see an improvement."

ITC has also narrowed the revenue gap between itself and Hindustan Unilever over the past 10 years. In FY05, Hindustan Unilever's domestic revenues were 10.5x that of ITC's FMCG business. Currently, HUL's FMCG business is only 2.7x of ITC's FMCG business. Two of its brands, Aashirwad and Sunfeast, are Rs 2,000 crore each. Sunfeast Yippee is the second-largest noodles brand after Maggi and has a marketshare of 15 per cent. ITC's wafers brand Bingo, too, has 15 per cent marketshare while Lays has 40 per cent in the wafers market.

Although the FMCG segment's share in profits is negligible at present, it is expected to improve. Morgan Stanley expects earnings growth of ITC's non-cigarette businesses to accelerate to 28 per cent CAGR over FY14-17 from 12 per cent levels.

Despite the cushion of the FMCG business, the stock will be hit if excise tax on cigarettes is higher than 20 per cent in FY15, claim analysts, as it would lead to a volume decline of more than three per cent.

ITC's FMCG business has attained significant scale over the past 10 years, with its share rising to 20 per cent of ITC's total revenues in FY14 from one per cent in 2002. The FMCG business has grown from Rs 70 crore in 2002 to Rs 10,400 crore in 2014. The growth trajectory of ITC's FMCG business is higher than any other FMCG company, say analysts. Says Nomura: "The company's performance in the FMCG business over the past 10 years gives us confidence that over the next five years, not only will the segment continue to deliver market-leading revenue growth, but profitability is also likely to see an improvement."

Although the FMCG segment's share in profits is negligible at present, it is expected to improve. Morgan Stanley expects earnings growth of ITC's non-cigarette businesses to accelerate to 28 per cent CAGR over FY14-17 from 12 per cent levels.

Despite the cushion of the FMCG business, the stock will be hit if excise tax on cigarettes is higher than 20 per cent in FY15, claim analysts, as it would lead to a volume decline of more than three per cent.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 30 2014 | 9:35 PM IST