Fund managers' actions can be good contra-indicators

There is a lag between the actions of fund managers and the time when this data come to you

)

premium

graph

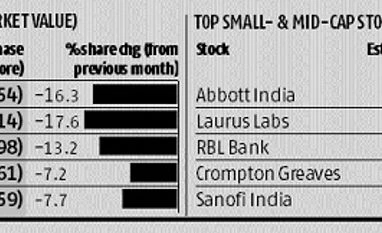

Sometimes, professional fund managers sell stocks because they are facing redemption pressure, and not because they have lost conviction in them. There is a lag between the actions of fund managers and the time when this data come to you. If prices have changed, what was a good buy a month earlier may no longer be so. Nonetheless, buy and sell data can be useful in some circumstances. Suppose you want to buy a stock but see that fund managers have been selling it in large volumes. You may want to pause and research further to check your views on the stock.