Getting education loans despite tougher norms

Despite banks' reluctance, it's possible for students of less reputed institutes to get these. Keep some basics in mind

)

The cost of higher studies has moved up substantially in recent years. Taking loans for courses in higher education in both India and abroad is almost a necessity. While these are more easily available than six to eight years ago, students who are not from reputed institutions might still have to struggle for a bank nod.

Speaking recently at the Business Standard Banking Round Table, Arundhati Bhattacharya, chairman of State Bank of India, the country's largest public sector lender, admitted banks were comfortable giving loans to students from top institutes but reluctant when it came to less recognised ones. "Education loans are not a problem at all for professional institutes such as the IITs, IIMs and even good colleges in tier-1 or tier-2 cities. The problem lies in giving loans to students in general streams and also studying in tier-3 and tier-4 institutions. Banks are unsure of these institutions' standards and whether the money will come back," she said.

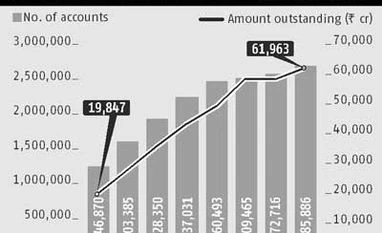

The reluctance has grown in recent months because of the high level of banks' non-performing assets (NPAs) in the sector. It is estimated that NPAs as a percentage of education loans for public sector banks (PSBs) was as high as eight to nine per cent.

Generally speaking, the assessment of a loan is based on the student's earning potential upon completion of the course. Banks look at reputation of the institute and its job placement record, employability from the course and the student's academic record. Banks do not say so in public but they do have a list of courses and institutions that they will be comfortable lending to. If your college or institution does not fall under this list, your loan request might get rejected.

What must students do to better their chances of a loan? First, if you know you will need financial assistance for higher studies, you need to maintain a good academic record. "If the student has applied to a less reputed institute or has plans to study for a course with a low employability quotient, only a good academic record might not suffice. The record has to be great," said Jairam Sridharan, president, head - consumer lending and payments, Axis Bank.

According to K P Singh, chief executive officer (CEO) at IMFS, an education consultancy, students should personally meet the loan officer or the person who sanctions the loan to strengthen their case. "They could present their resume, discuss their plans and benefits of pursuing the course, and give details about their academic record and other skill sets," said Singh. He added students should approach several banks, not focus only on the ones they bank with.

Banks are also increasingly getting wary of courses that do not guarantee a high paying job after graduating. "The course fee and the job salary should have a correlation but that's not always the case," said an official from a PSB, on condition of anonymity. He cites the example of nursing courses, where defaults are higher because of the high fees. "The salaries that students get after passing out from these colleges is not enough to service the loans," he said.

What often works against these students is simple mathematics. Let's say a student doing an MBA course from a less reputed institute takes a Rs 10 lakh loan. The amount will increase to Rs 12-13 lakh by the time he finishes the course. Assume he gets a job with annual salary of Rs 3.5 lakh or roughly Rs 30,000 a month. The equated monthly installment works out to Rs 20,000 and he will find it difficult to keep paying this much.

So, it is important that students assess the employability of the courses they enrol in. First, make a list of all the courses that interest you. Then, check if students doing that course have been able to get jobs easily or struggled to land one in the past two years. "If bankers find that getting a job after doing a particular course is difficult, they will be reluctant to give loans," said Sridharan.

"If courses in retail, health care, finance/micro finance and telecom, areas expected to do well, especially in tier-3 and tier-4 cities, banks will be more willing to give loans," said Rajiv Raj, co-founder and director, creditvidya.com, a technology firm that works in the area of credit education.

Another important thing is to research the placement record of the institutes one plans to get into. They should talk to students who have graduated from the institute and find if they were able to land jobs easily. Also, students have to make sure the institute is accredited or affiliated to universities recognised by the University Grants Commission, All India Council for Technical Education or the like.

Students would also do well not to limit their options in selecting of courses or a particular area of interest. For example, if their interest is in finance and they haven't managed to get admission to any of the top colleges, they should broaden their horizons and look at allied areas of interest.

The good news for students is that several PSBs have expanded into smaller cities and are willing to give loans to students from the smaller institutes. "Getting loans might be a bit more tedious and less speedy but if you have a good rapport with the branch manager of the bank, it shouldn't be a problem getting a loan of up to Rs 4 lakh," said Neeraj Saxena, CEO, Avanse Financial Services. These students, however, need to keep in mind that they might have to pay an extra interest of 0.5-1 per cent on the amount borrowed, as well as provide extra collateral or an additional guarantor to get the loan sanctioned.

Students also have the option to approach a non-banking finance company (NBFC). "We are getting good demand for domestic as well as overseas courses. We offer loans of anywhere between Rs 1 lakh and Rs 50 lakh, and offer competitive interest rates vis-a-vis banks," said Saxena. Sectoral officials believe NBFCs could charge anywhere between half a per cent and one per cent more than banks for education loans.

Students with a family income of less than Rs 4.5 lakh can even apply for education loans under the Central Scheme for Interest Subsidy. Under this, the interest payable by a student availing an educational loan for technical & professional courses for the period of moratorium (i.e course period plus one year or six months after getting a job, whichever is earlier) under the Educational Loan Scheme of the Indian Banks' Association shall be borne by the government. After the period of moratorium, the interest on the dues shall be paid by the student, in accordance with the provisions of the existing Educational Loan Scheme.

There are few more things to consider. Most students who apply for loans don't have a credit track record. If a student has been using a credit card, he should pay his dues and remain debt-free before applying for a loan. This will increase the bank's confidence, albeit in a small way, in the student's repayment capability. Students would also do well to go for secured loans and make their parents co-applicants. If the parent's house is put up as security, the interest rates charged could be lower by 150-250 basis points, say experts.

Speaking recently at the Business Standard Banking Round Table, Arundhati Bhattacharya, chairman of State Bank of India, the country's largest public sector lender, admitted banks were comfortable giving loans to students from top institutes but reluctant when it came to less recognised ones. "Education loans are not a problem at all for professional institutes such as the IITs, IIMs and even good colleges in tier-1 or tier-2 cities. The problem lies in giving loans to students in general streams and also studying in tier-3 and tier-4 institutions. Banks are unsure of these institutions' standards and whether the money will come back," she said.

The reluctance has grown in recent months because of the high level of banks' non-performing assets (NPAs) in the sector. It is estimated that NPAs as a percentage of education loans for public sector banks (PSBs) was as high as eight to nine per cent.

Generally speaking, the assessment of a loan is based on the student's earning potential upon completion of the course. Banks look at reputation of the institute and its job placement record, employability from the course and the student's academic record. Banks do not say so in public but they do have a list of courses and institutions that they will be comfortable lending to. If your college or institution does not fall under this list, your loan request might get rejected.

What must students do to better their chances of a loan? First, if you know you will need financial assistance for higher studies, you need to maintain a good academic record. "If the student has applied to a less reputed institute or has plans to study for a course with a low employability quotient, only a good academic record might not suffice. The record has to be great," said Jairam Sridharan, president, head - consumer lending and payments, Axis Bank.

According to K P Singh, chief executive officer (CEO) at IMFS, an education consultancy, students should personally meet the loan officer or the person who sanctions the loan to strengthen their case. "They could present their resume, discuss their plans and benefits of pursuing the course, and give details about their academic record and other skill sets," said Singh. He added students should approach several banks, not focus only on the ones they bank with.

Banks are also increasingly getting wary of courses that do not guarantee a high paying job after graduating. "The course fee and the job salary should have a correlation but that's not always the case," said an official from a PSB, on condition of anonymity. He cites the example of nursing courses, where defaults are higher because of the high fees. "The salaries that students get after passing out from these colleges is not enough to service the loans," he said.

| STUDENT LOAN: DO YOUR HOMEWORK |

|

What often works against these students is simple mathematics. Let's say a student doing an MBA course from a less reputed institute takes a Rs 10 lakh loan. The amount will increase to Rs 12-13 lakh by the time he finishes the course. Assume he gets a job with annual salary of Rs 3.5 lakh or roughly Rs 30,000 a month. The equated monthly installment works out to Rs 20,000 and he will find it difficult to keep paying this much.

"If courses in retail, health care, finance/micro finance and telecom, areas expected to do well, especially in tier-3 and tier-4 cities, banks will be more willing to give loans," said Rajiv Raj, co-founder and director, creditvidya.com, a technology firm that works in the area of credit education.

Another important thing is to research the placement record of the institutes one plans to get into. They should talk to students who have graduated from the institute and find if they were able to land jobs easily. Also, students have to make sure the institute is accredited or affiliated to universities recognised by the University Grants Commission, All India Council for Technical Education or the like.

Students would also do well not to limit their options in selecting of courses or a particular area of interest. For example, if their interest is in finance and they haven't managed to get admission to any of the top colleges, they should broaden their horizons and look at allied areas of interest.

The good news for students is that several PSBs have expanded into smaller cities and are willing to give loans to students from the smaller institutes. "Getting loans might be a bit more tedious and less speedy but if you have a good rapport with the branch manager of the bank, it shouldn't be a problem getting a loan of up to Rs 4 lakh," said Neeraj Saxena, CEO, Avanse Financial Services. These students, however, need to keep in mind that they might have to pay an extra interest of 0.5-1 per cent on the amount borrowed, as well as provide extra collateral or an additional guarantor to get the loan sanctioned.

Students also have the option to approach a non-banking finance company (NBFC). "We are getting good demand for domestic as well as overseas courses. We offer loans of anywhere between Rs 1 lakh and Rs 50 lakh, and offer competitive interest rates vis-a-vis banks," said Saxena. Sectoral officials believe NBFCs could charge anywhere between half a per cent and one per cent more than banks for education loans.

Students with a family income of less than Rs 4.5 lakh can even apply for education loans under the Central Scheme for Interest Subsidy. Under this, the interest payable by a student availing an educational loan for technical & professional courses for the period of moratorium (i.e course period plus one year or six months after getting a job, whichever is earlier) under the Educational Loan Scheme of the Indian Banks' Association shall be borne by the government. After the period of moratorium, the interest on the dues shall be paid by the student, in accordance with the provisions of the existing Educational Loan Scheme.

There are few more things to consider. Most students who apply for loans don't have a credit track record. If a student has been using a credit card, he should pay his dues and remain debt-free before applying for a loan. This will increase the bank's confidence, albeit in a small way, in the student's repayment capability. Students would also do well to go for secured loans and make their parents co-applicants. If the parent's house is put up as security, the interest rates charged could be lower by 150-250 basis points, say experts.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 15 2014 | 12:17 AM IST