Make time your ally in wealth creation

Don't make the mistake of investing long-term money into shorter duration buckets

)

"Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't, pays it."

-Albert Einstein

In an age of instant gratification, be it instant coffee or 30-minute pizza delivery, investors are always on the lookout for that secret sauce or formula that will make them rich in quick time. The result is that they behave like people wearing blinkers, fixated only on the kind of "returns" they will make from their investment, and giving little thought to the "time" they will have to stay invested to get those returns.

Let's take a simple example to illustrate this point. Amit and Sumit are two investors who invest in two different products, one favouring safety but with a longer time horizon and the other favouring higher returns. Both invest Rs 1 lakh, with Amit earning 5 per cent p.a. and Sumit 20 per cent p.a. Amit stays invested for 20 years, while Sumit is locked in for five years.

To those unfamiliar with the power of compounding, it would seem that Sumit would end up making more money. But it's Amit, in fact, who ends up with a higher maturity amount of Rs 2,65,330, about Rs 16,500 more than Sumit's Rs 2,48,832.

If you are like Sumit you probably focus on just one side of the picture (return), missing the second and more important side (time horizon). Let us go back to the wealth creation formula we learned in school:

A=P*(1+r)ˆn where, A=Amount; P=Principal, r=Return on Investment; n=Time Period

It doesn't mean that return is not important but the exponential growth comes from time horizon of investments. The 'n' factor acts as a spring board to the 'r' factor. The jump of 'r' rises multifold as the time factor 'n' increases. Hence optimising both the 'r' & 'n' is the winning combination to wealth creation.

Not all goals are long-term

Some, but not all, of our goals are long-term. In reality some of our goals and needs arise over the short term and some over a medium term horizon. What should one do in such cases?

Let us understand two things. First is the safety aspect of the product type or category and second the return potential of products across various time horizons of investments. Let's decode the safety aspects of which product work best for different time horizons.

Analysis of 20-year data shows that if one invested in the equity market for a period of one year there would be a 62 per cent probability of making money and the person would have lost money 38 per cent of the time. As the time horizon increases to two, three and five years the probability of making money from the equity market increases to 73 per cent, 78 per cent and 85 per cent, respectively. For a 10-year period, the probability goes up to 100 per cent.

Similarly, a balanced fund would have delivered positive returns if one stayed invested for three years or more, while investments in a product such as a monthly income plan would have delivered returns for a time horizon of two years and more.

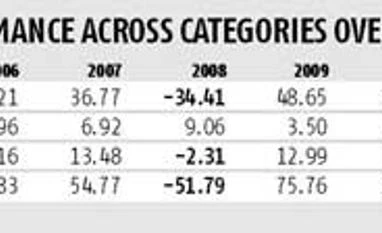

I am deliberately sharing the discrete performance of various categories for each calendar year over the last 10 years so that the recent good or bad performance does not become misleading.

Three things can help create wealth. First, if you have long-term money to invest, don't make the mistake of investing for shorter time horizon buckets. Second, pick products that suit the time horizon. For example, the equity fund CAGR is slightly over 15% p.a, meaning you can double your money in less than five years. This is best suitable for investors willing to take a little more risk and who have a slightly longer time horizon of seven to 10 years.

Third, remember that the market can give non-linear returns. The markets will always be volatile and will test both your emotions of greed and fear. Once you have carefully picked the products and stay the course you will make your money. You can analyse data or past market cycles to ride over your emotions and create wealth.

Alam is Founder & CEO, Fincart

-Albert Einstein

In an age of instant gratification, be it instant coffee or 30-minute pizza delivery, investors are always on the lookout for that secret sauce or formula that will make them rich in quick time. The result is that they behave like people wearing blinkers, fixated only on the kind of "returns" they will make from their investment, and giving little thought to the "time" they will have to stay invested to get those returns.

Let's take a simple example to illustrate this point. Amit and Sumit are two investors who invest in two different products, one favouring safety but with a longer time horizon and the other favouring higher returns. Both invest Rs 1 lakh, with Amit earning 5 per cent p.a. and Sumit 20 per cent p.a. Amit stays invested for 20 years, while Sumit is locked in for five years.

To those unfamiliar with the power of compounding, it would seem that Sumit would end up making more money. But it's Amit, in fact, who ends up with a higher maturity amount of Rs 2,65,330, about Rs 16,500 more than Sumit's Rs 2,48,832.

If you are like Sumit you probably focus on just one side of the picture (return), missing the second and more important side (time horizon). Let us go back to the wealth creation formula we learned in school:

A=P*(1+r)ˆn where, A=Amount; P=Principal, r=Return on Investment; n=Time Period

It doesn't mean that return is not important but the exponential growth comes from time horizon of investments. The 'n' factor acts as a spring board to the 'r' factor. The jump of 'r' rises multifold as the time factor 'n' increases. Hence optimising both the 'r' & 'n' is the winning combination to wealth creation.

Not all goals are long-term

Some, but not all, of our goals are long-term. In reality some of our goals and needs arise over the short term and some over a medium term horizon. What should one do in such cases?

Let us understand two things. First is the safety aspect of the product type or category and second the return potential of products across various time horizons of investments. Let's decode the safety aspects of which product work best for different time horizons.

Similarly, a balanced fund would have delivered positive returns if one stayed invested for three years or more, while investments in a product such as a monthly income plan would have delivered returns for a time horizon of two years and more.

I am deliberately sharing the discrete performance of various categories for each calendar year over the last 10 years so that the recent good or bad performance does not become misleading.

Third, remember that the market can give non-linear returns. The markets will always be volatile and will test both your emotions of greed and fear. Once you have carefully picked the products and stay the course you will make your money. You can analyse data or past market cycles to ride over your emotions and create wealth.

Alam is Founder & CEO, Fincart

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 27 2014 | 9:02 PM IST