Time to lock in your fixed deposit

Act now, as bank deposit rates are likely to come down in the near future; supplement this with a few other instruments

)

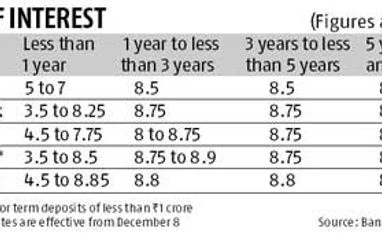

Banks such as State Bank of India, (SBI) ICICI Bank, HDFC Bank, Axis Bank and IDBI Bank have cut interest rates last week on retail term deposits. Similar cuts in deposit rates by other banks could be in the offing. More so after the Reserve Bank of India (RBI) recently hinted at a cut in key policy rates early next year.

If a conservative investor who prefers low-risk instruments such as bank fixed deposits (FDs), this might be your last chance to lock in your money before interest rates start heading south.

The country's top bankers are unanimous in their vote in favour of FDs. Speaking at the Business Standard Banking Round Table last week, Arundhati Bhattacharya, chairman of State Bank of India, the country's largest public sector bank, said depositors are currently gaining money by putting it in bank deposits. Aditya Puri, managing director (MD) of HDFC Bank, seconds this. "I strongly recommend people access these deposits," he said.

According to Shikha Sharma, MD and chief executive officer (CEO) at Axis Bank, savers finally have real, positive rates, after two years. Real returns are actual returns minus inflation. "Gold prices have been coming off. Real estate prices, at least in the large markets, have not actually gone up that much either. So, for a rational saver, this is a good time to allocate money to financial assets. And, within financial assets, have a balance between debt and equity," she said.

Real returns have turned positive as banks are offering eight to nine per cent on deposits of one to three years, higher than the current retail inflation figures. All-India Consumer Price Index (CPI) inflation declined to 5.5 per cent in October from 6.5 per cent in September, driven by a sharp decline in the rate of price for food articles. This is the lowest since January 2012. "As long as bank FDs offer more than 5.5 per cent, the real returns will be positive," says D K Joshi, senior director & chief economist, CRISIL.

However, economists attribute the low inflation numbers to the base effect and say the CPI number in December will be the one to watch, as that's the month the base effect will wear off. Yet, they're also optimistic that inflation will not rear its ugly head in the coming months. "We expect CPI inflation to remain between 5.5 per cent and six per cent between December and February. This is because global crude oil prices are expected to remain subdued, at $70-75 a barrel till February. The dismal kharif crop production is likely to put upward pressure on food inflation but it's unlikely to be as high as last year," said Madan Sabnavis, chief economist, CARE Ratings.

According to Joshi, the inflation curve hinges largely on the movement of global crude oil prices.

RBI in its bi-monthly monetary policy statement last week, said: "Consistent with the balance of risks set out in the fourth bi-monthly monetary policy statement of September, headline inflation has been receding steadily and current readings are below the January 2015 target of eight per cent, as well as the January 2016 target of six per cent."

If inflation numbers remain under control, RBI will act to bring down interest rates. So, as an FD investor, you need to act now. "With interest rates expected to head south, you are likely to get better returns from an FD now than a few months down the line," said Hemant Rustagi, CEO, Wiseinvest Advisors.

FDs typically come with a re-investment risk. To avoid having to settle for lower interest rates when their short-term deposits come for renewal, experts advise that FD investors lock in their money for a higher duration, such as three to five years or till such time that interest rates become conducive to reinvest their money.

FD investors, especially those in a higher tax bracket, would also do well to look at other investment avenues. "Investors should ideally look at a combination of two to three instruments, depending on factors such as liquidity, tax efficiency and higher returns," said Rustagi. He recommends investors put money in a combination of short-term debt funds, equity savings income funds and FDs, rather than solely in FDs.

Kartik Jhaveri, director at Transcend Consulting, feels bonds and debentures in the secondary market are another option. "These will offer a longer-term investment opportunity of seven to 10 years. For retail investors, liquidity could be an issue and they might have to compromise on the price. But tax-free bonds, senior citizen savings schemes and medium-term income funds are also (good) options, in addition to bank FDs."

The interest earned by FD investors is added to their income, to be taxed on their individual slab rates. So, if you are in the 30 per cent tax bracket and you get nine per cent on the FD, the effective yield works to around six per cent, after deducting tax.

If a conservative investor who prefers low-risk instruments such as bank fixed deposits (FDs), this might be your last chance to lock in your money before interest rates start heading south.

The country's top bankers are unanimous in their vote in favour of FDs. Speaking at the Business Standard Banking Round Table last week, Arundhati Bhattacharya, chairman of State Bank of India, the country's largest public sector bank, said depositors are currently gaining money by putting it in bank deposits. Aditya Puri, managing director (MD) of HDFC Bank, seconds this. "I strongly recommend people access these deposits," he said.

According to Shikha Sharma, MD and chief executive officer (CEO) at Axis Bank, savers finally have real, positive rates, after two years. Real returns are actual returns minus inflation. "Gold prices have been coming off. Real estate prices, at least in the large markets, have not actually gone up that much either. So, for a rational saver, this is a good time to allocate money to financial assets. And, within financial assets, have a balance between debt and equity," she said.

Real returns have turned positive as banks are offering eight to nine per cent on deposits of one to three years, higher than the current retail inflation figures. All-India Consumer Price Index (CPI) inflation declined to 5.5 per cent in October from 6.5 per cent in September, driven by a sharp decline in the rate of price for food articles. This is the lowest since January 2012. "As long as bank FDs offer more than 5.5 per cent, the real returns will be positive," says D K Joshi, senior director & chief economist, CRISIL.

However, economists attribute the low inflation numbers to the base effect and say the CPI number in December will be the one to watch, as that's the month the base effect will wear off. Yet, they're also optimistic that inflation will not rear its ugly head in the coming months. "We expect CPI inflation to remain between 5.5 per cent and six per cent between December and February. This is because global crude oil prices are expected to remain subdued, at $70-75 a barrel till February. The dismal kharif crop production is likely to put upward pressure on food inflation but it's unlikely to be as high as last year," said Madan Sabnavis, chief economist, CARE Ratings.

RBI in its bi-monthly monetary policy statement last week, said: "Consistent with the balance of risks set out in the fourth bi-monthly monetary policy statement of September, headline inflation has been receding steadily and current readings are below the January 2015 target of eight per cent, as well as the January 2016 target of six per cent."

If inflation numbers remain under control, RBI will act to bring down interest rates. So, as an FD investor, you need to act now. "With interest rates expected to head south, you are likely to get better returns from an FD now than a few months down the line," said Hemant Rustagi, CEO, Wiseinvest Advisors.

FDs typically come with a re-investment risk. To avoid having to settle for lower interest rates when their short-term deposits come for renewal, experts advise that FD investors lock in their money for a higher duration, such as three to five years or till such time that interest rates become conducive to reinvest their money.

FD investors, especially those in a higher tax bracket, would also do well to look at other investment avenues. "Investors should ideally look at a combination of two to three instruments, depending on factors such as liquidity, tax efficiency and higher returns," said Rustagi. He recommends investors put money in a combination of short-term debt funds, equity savings income funds and FDs, rather than solely in FDs.

Kartik Jhaveri, director at Transcend Consulting, feels bonds and debentures in the secondary market are another option. "These will offer a longer-term investment opportunity of seven to 10 years. For retail investors, liquidity could be an issue and they might have to compromise on the price. But tax-free bonds, senior citizen savings schemes and medium-term income funds are also (good) options, in addition to bank FDs."

The interest earned by FD investors is added to their income, to be taxed on their individual slab rates. So, if you are in the 30 per cent tax bracket and you get nine per cent on the FD, the effective yield works to around six per cent, after deducting tax.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 07 2014 | 11:39 PM IST