New Year Offer: Reliance Jio shows telecom price war is far from over

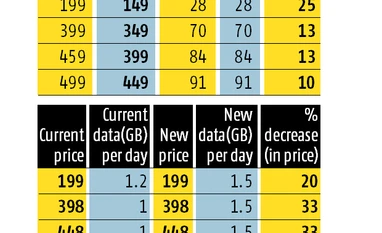

Reliance Jio unleashed another price war by reducing its average tariffs across offers by 10-25 per cent and increasing the data allowance 50 per cent on its packs

)

Reliance Jio's New Year Offer

If you thought telecom price wars were over and the average revenue per user would stabilise and increase, think again.

Last week Reliance Jio unleashed another price war when it reduced its average tariffs across offers by 10-25 per cent.

Also, by increasing the data allowance 50 per cent on its packs, it effectively cut prices by 20-33 per cent.

After these cuts, Jio has brought average tariffs down to what they were before Diwali last year.

The move is understandable because Jio according to sources is looking at expanding its subscriber base by another 100 million in the next 12 months, or about eight million net additions every month. That will bring it closer to the 250-million subscriber mark, closing the gap that it has with its rivals Bharti Airtel (which, along with Telenor, has a subscriber base of 329 million) and the Vodafone-Idea combine, which has 398 million.

Also Read

That will enable it to have more than a 20 per cent share of the market, which will have primarily three big players.

However, Jio’s initial price advantage was challenged by incumbent competitors like Airtel, which matched its offers.

So, analysts say, the 450-million feature phone users had less of a reason to shift to 4G and leave their existing services or add another SIM. Also, many of these telcos have introduced bundled offers with devices at attractive prices to take the edge off the Jio offer.

Jio is following a three-pronged strategy: Wooing feature phone users by reducing tariffs and seeding the Rs 1500 feature phone (which is effectively free), which is powered by 4G; and also grab subscribers from telcos like Reliance Communications, which has closed its wireless business, or from Idea-Vodafone, which is in the midst of a complex merger.

However, bundled feature phones, which were offered under a booking scheme, seem to have not made much of a dent in the market because Jio was able to deliver only six million of these last year.

However, bundled feature phones, which were offered under a booking scheme, seem to have not made much of a dent in the market because Jio was able to deliver only six million of these last year.

Reliance Jio's New Year Offer

It has now changed its strategy and the phones are being distributed through its own stores as well as independent ones, and the plan is to put in seven-eight million every month. Analysts such as UBS point out that ARPU increases will happen in 2019 and not this year. That is because the implosion of smaller operators had provided opportunities for incumbent operators to gain market share and ARPU increase had taken the back seat. They point out that continuing the use of double SIM (which constitutes for the bulk of Jio customers) has prevented telcos from effecting major price increases. Also there has been acceleration in the growth of 4G customers due to low tariffs, which could get impacted if tariffs were pushed up.

Most analysts say the focus will be on subscriber market share gain rather than revenue share gain. According to Citibank, Jio’s revenue share in the second quarter of FY18 stood at 15 per cent, which is half that of Bharti, while Vodafone-Idea’s was 38 per cent. It points out that telcos with strong networks and good execution remain better placed in this market rather than Vodafone-Idea, which remains vulnerable to market share loss.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 10 2018 | 12:40 AM IST