Realty check: Homebuyers caught between banks and builders

Insolvency against Jaypee Infratech, builders hang in balance as SC to hear aggrieved homebuyers

)

premium

.

Last Updated : Sep 03 2017 | 6:35 PM IST

When the Reserve Bank of India (RBI) moved to fast-track the insolvency process in some of the key stressed accounts, it probably did not expect an army of middle-class and upper-middle-class people to come in the way. But, two months since it released a list of 12 large accounts, which were to be cleared through the route, that is exactly what it is facing in the matter of Jaypee Infratech, whose aggrieved flatbuyers run into several thousands.

On Monday, September 4, the Supreme Court will hear a writ petition filed by Chitra Sharma, a flatbuyer, against an order by the National Company Law Tribunal. “We are challenging the constitutional validity of the Insolvency and Bankruptcy Code. This law does not recognise the rights of the homebuyers, and recent rulings have said the homebuyer is neither a financial creditor nor an operational creditor,’’ Aishwarya Sinha, Sharma’s lawyer, told Business Standard. Sinha said once notice was issued, other flatbuyers were likely to implead in the matter with their own submissions.

Harassed buyers

Col. SK Nagarath, a retired army dentist in his 80s, is a figure several homebuyers now look up to. The president of the Jaypee Aman Owners Welfare Association is busy finalising an impleadment in Sharma’s petition, which many feel could have been researched and drafted better. The association, which has hired the services of a senior advocate, is also busy tying up finances for this legal expedition. Each interested member has been asked to pay Rs 5,000.

Among the issues the association is planning to raise are the alleged financial irregularities and a demand for a forensic audit. Nagarath says as the homebuyers had paid their money even before banks lent to the project, they should have priority over the banks.

Nagarath and the homebuyers have already submitted a request for investigation with the Union Ministry of Corporate Affairs, citing extracts of annual report of Jaypee Infratech and other publicly available documents. “It is a gambit, which they have played in collusion with the banks. Our money has been siphoned off,’’ he said.

He explained how the crisis had hit various families, especially the middle-class and lower-income groups.

Many of them have paid 90 per cent or more of the cost of their apartments. The amount invested ranges from as low as Rs 25 lakh to a few crores, in some of the higher-end projects.

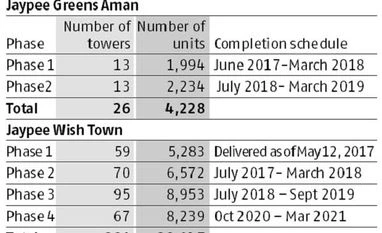

Jaypee flatbuyers have seen the trouble for nearly five years now. But in May, things came to a head after some flatbuyers filed an FIR charging Jaypee Infratech managing director Manoj Gaur with cheating and criminal conspiracy. Around this time, the group had put up a four-phase schedule for delivery of over 30,000 units. The timeline began from June 2017 and was extended till 2021.

Separately, the group had also promised refund of money in some scrapped projects. In that backdrop, a National Company Law Tribunal order of August 9 put a moratorium on all other claims and proceedings and appointed chartered accountant Anuj Jain from BSR Associates as the interim resolution professional.

A similar problem is faced by about 40,000 flatbuyers of Amrapali group, another builder with several projects in Noida. But, the NCLT order is yet to come in this matter.

Emails seeking comments from Jaypee group, Amarapali group and the Noida Authority did not elicit any response.

The beginning and scale

The opening on Delhi Noida Direct Flyway in 2001 brought the satellite town closer to South Delhi, triggering a flurry of development along the eastern banks of Yamuna. What looked like a boom has turned into a nightmare. According to experts, the problems started in the early 2000s when the Uttar Pradesh government was in a hurry to develop acres of land parcels in Noida and Greater Noida. To bring in more developers, the Noida land authorities decided to take an ‘out of the box’ approach and started giving away land at 10 per cent of the actual amount for a 99-year lease.

“The land was being offered at a fraction of the lease amount. This made developers greedy and they started taking large pockets of land not realising that it would be unmanageable. They then over-developed with the surplus land but they could not find many buyers,” said Parveen Jain, president of industry body Naredco.

Jaypee group, through its vehicle Jaiprakash Industries, had won the concession agreement to develop what was originally Taj Expressway in 2003. The agreement included right to develop an area of 2500 hectares (25 million square feet), divided into five parcels of 500 hectares each. Three of these land parcels were in the Noida-greater Noida area, while the other two were in Mirzapur (Aligarh district) and Agra. Jaypee group sold these projects under the banner of Jaypee Greens. It roped in Canadian architects Arcop Associates to develop premium properties linked to golf courses and other luxury living paraphernalia. By early 2010, it had sold 88 per cent of the space it had on offer. At over Rs 900 crore, funds from real estate operations provided a big cushion for the highly levered project. While equity was about Rs 1,250 crore, debt stood at over Rs 4,400 crore. Even as promoters sold part of their shares to raise around Rs 600 crore in the 2010 initial public offering, flatbuyers continued to put in funds.

On top of all this was corruption, irrespective of the party in power, with politicians and officials demanding huge cuts from builders, sometimes paid on per square foot basis. In the IPO document, Jaypee Infra had mentioned a risk factor on politics in Uttar Pradesh. “If there is a change in power or if a coalition government is elected in the future, the policies of the state government with respect to transportation (including toll rates) and development could be revised, or the effective implementation of such policies could be impeded, either of which could have an adverse effect our business.” It’s no secret that the company, which was part of the larger group of realty, infrastructure and power firms led by Jaiprakash Gaur had a good-run under the Bahujan Samaj Party government headed by Mayawati.

Jaypee Infratech, which was essentially a special purpose vehicle to develop 165-km Yamuna Express way and five townships along the new road, had structured its timelines in such a way that most of these are completed before the 2012 elections. But, delays began to creep in. The expressway itself opened only in August 2012, five months after the Samajwadi Party came to power.

Other external factors also turned less favourable. “As the demand calculations were neither in sync with the job market nor with the essential infrastructure in the micro market, the projects were always going to be on a shaky wicket,” said Amol Shimpi, associate dean and director, RICS School of Built Environment.

Recent steps

Noida Authority has sought permission from the state government to take over unsold residential units in half-a-dozen projects of Amrapali group. The aim is to use the proceeds from the sale of this unsold inventory. Amrapali group owes the Authority over Rs 1,200 crore and has to deliver nearly 40,000 residential units to homebuyers.

The Noida Authority had in July issued occupancy certificates allowing possession and registry of 1,000 out of total 5,000 flats proposed in Jaypee’s Aman housing project located in Sector 151 along the Noida Expressway. On August 2, the Yamuna Expressway Authority asked Jaypee to refund advances received for about 3,000 studio apartments near the Buddh Formula 1 circuit. But, these steps are in a limbo after the NCLT order.

The Noida Authority last week also relaxed the terms for issuing occupancy certificates to select stuck housing projects that fulfil certain conditions, a move that could benefit around 20,000 homebuyers. The new policy is for only those housing projects, where the builder has developed common facilities.

Possible solutions

In its annual report for 2015-16, Jaypee Infra had said, ‘’the company has launched around 134.40 million sq ft area and has sold 128.20 million sq ft area till March 31, 2016, aggregating to sales value of Rs 24,295 crore.” Homebuyers are questioning the accounting treatment.

Despite several FAQs and clarifications put out by the IRP, experts feel clarity is still missing on the modalities of payments in case of insolvency code. Rakesh Nangia, Managing Partner, Nangia & Co, said, “Homebuyers facing undue delays saw insolvency code as their ray of hope. However, NCLT held that homebuyers do not qualify as an ‘operational creditor’ and also cannot be treated as ‘financial creditors’ since such debts are not disbursed against the consideration of the time value of money. This gave rise to a possible interpretation that certain kinds of debts may not fit into either of the debt buckets (financial or operation).’’

Real estate industry bodies are now demanding government intervention and support to complete these projects, hand them over to homebuyers and make the market viable again.

“Someone needs to jump in, either the government or local authorities need to intervene, help in getting finances so that the crisis can be resolved,” said Jain of Naredco. Some believe project restructuring is necessary. “Firstly, fast-track the debt resolutions under the bankruptcy code, identify strong real estate players who are willing to replace the beleaguered developers and thirdly counsel the customers about demand for additional time, money or both,” Shimpi added.

Nagarath of the Owners Welfare Association said the solution lies within the group itself. “Land was allotted to them at 50 paise per square metre. Just the Formula 1 (Buddh Circuit) can generate huge money, enough to pay off significant portion of their debts. There are buyers, but not to their expectations. That’s why they are holding on to enjoy future gains.” He warned things could turn ugly if convincing action is not forthcoming, “The government and courts need to step in and solve this quickly. Or, with lakhs of lives involved, this can quickly deteriorate into a law and order problem.”