RBI clamps down on easy money, again

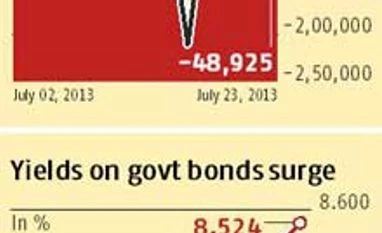

Overnight rates may hit double digits; bond yields to spike

)

Exactly a week after tightening liquidity to stabilise the volatility of the rupee, the Reserve Bank of India (RBI) on Tuesday imposed new restrictions on commercial banks’ access to cash.

Experts said call rates and bond yields would rise sharply as a result of the RBI action. “The impact of the steps will have significant impact on banks. Both call rates and bond yields will increase sharply,” said Andhra Bank Chairman and Managing Director B Prabhakar.

The rupee, which has been one of Asia’s worst-performing currencies this year and has fallen 10 per cent against the dollar since the start of May, on Tuesday closed slightly weaker at 59.76 a dollar.

In a statement, RBI said banks would be permitted to borrow under the liquidity adjustment facility (LAF) only up to 0.5 per cent (lowered from one per cent) of their net deposits and time liabilities at the benchmark interest rate of 7.25 per cent.

Additionally, RBI has tightened rules on the cash reserve ratio (CRR), or the percentage of deposits banks must keep in cash with the central bank. Now, banks will have to hold cash equivalent of at least 99 per cent of CRR on a daily basis, compared with 70 per cent earlier. While the LAF borrowing norms will be effective immediately, the stipulation on CRR will take effect from next fortnight.

RBI has not lowered the aggregate borrowing cap of Rs 75,000 crore through LAF that it had set last Monday in its first round of liquidity-tightening measures. In effect, however, banks’ LAF borrowings will be reduced by half. If banks want more funds, they will have to borrow from the marginal standing facility (MSF), under which interest is charged at higher rate of 10.25 per cent.

“Effectively, the repo rate becomes the marginal standing facility rate, and we have to adjust to this new rate regime. The steps show the central bank wants to stabilise the rupee,” said SBI Chairman Pratip Chaudhuri.

RBI’s recent steps to curb forex market volatility

July 8

Experts said call rates and bond yields would rise sharply as a result of the RBI action. “The impact of the steps will have significant impact on banks. Both call rates and bond yields will increase sharply,” said Andhra Bank Chairman and Managing Director B Prabhakar.

The rupee, which has been one of Asia’s worst-performing currencies this year and has fallen 10 per cent against the dollar since the start of May, on Tuesday closed slightly weaker at 59.76 a dollar.

In a statement, RBI said banks would be permitted to borrow under the liquidity adjustment facility (LAF) only up to 0.5 per cent (lowered from one per cent) of their net deposits and time liabilities at the benchmark interest rate of 7.25 per cent.

RBI has not lowered the aggregate borrowing cap of Rs 75,000 crore through LAF that it had set last Monday in its first round of liquidity-tightening measures. In effect, however, banks’ LAF borrowings will be reduced by half. If banks want more funds, they will have to borrow from the marginal standing facility (MSF), under which interest is charged at higher rate of 10.25 per cent.

“Effectively, the repo rate becomes the marginal standing facility rate, and we have to adjust to this new rate regime. The steps show the central bank wants to stabilise the rupee,” said SBI Chairman Pratip Chaudhuri.

RBI’s recent steps to curb forex market volatility

July 8

- Banks barred from proprietary trading in currency futures and exchange-traded options

- Lenders allowed to trade only on behalf of clients

- Borrowings under LAF capped at ~75,000 crore

- The lending rate for MSF fixed 300 basis points above repo rate, at 10.5%

- Open-market sale of bonds worth ~12,000 crore

- LAF borrowing cap further tightened to 0.5% of each bank’s deposits

- Banks must keep daily CRR balance of 99% of requirement

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jul 24 2013 | 12:59 AM IST