FII holding falls to three-year low in December quarter

Likely to fall further in ongoing quarter on sell momentum

)

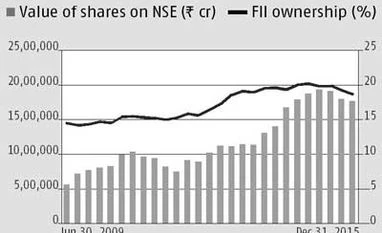

According to data compiled by Prime Database, percentage FII holding in 1,000-odd companies listed on the National Stock Exchange (NSE) stood at 18.67 per cent, lowest since March 2013.

Notably, FII ownership in Indian companies has declined for a fourth straight quarter. It has come off by 134 basis points during this period. FIIs' shareholding was down 55 basis points in the December quarter over the preceding September quarter. The fall in shareholding was despite muted outflows by FIIs. In the December quarter, FIIs had net sold shares worth only $334 million. The Sensex in the three months to December was almost unchanged.

FII shareholding is expected to come off sharply in the ongoing quarter, given the sharp sell-off. So far during the quarter, FIIs have pulled out over $2 billion from stocks, triggering a 12 per cent fall in the Sensex. If the selling pressure continues, the sell-off this quarter could top $2.6-billion selling seen in the September quarter.

Also, given the fall in the stock markets, value of FII holding is expected to drop further in the current quarter. The benchmark Sensex on Thursday ended at its lowest level since May 2014, with the Sensex dropping below 23,000. The value of FII holding in the June 2014 quarter was Rs 16.8 lakh crore, according to Prime Database.

HDFC remained the stock with the highest FII holding at 78 per cent, followed by Shirram Transport at 63 per cent, and Indiabulls Housing Finance at 57.5 per cent. Stocks which saw the biggest jump in FII holdings in one year to December were SE Power, where foreign investors increased their holding by 40.3 percentage points, followed by Cerebra Integrated and Rainbow Papers at 32.8 and 28 percentage points, respectively.

On the other hand, Max India, Jubilant Foodworks, and Amtek Auto, saw highest decline in FII holding at around 25 percentage points each.

Top foreign investors in terms of their exposure to Indian stocks included Europacific Growth, government of Singapore, and Oppenheimer Developing Markets Fund. Europacific had exposure of nearly Rs 45,000 crore to 13 Indian companies at the end of the December quarter. The government of Singapore has invested in 24 companies, with a total holding of nearly Rs 30,000 crore.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 11 2016 | 10:50 PM IST