Adani acquisition spree worries investors

Fifth acquisition in 18 months takes total buyout value to about Rs 20,000 crore

)

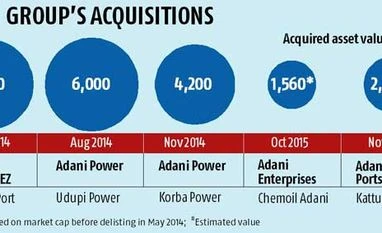

It was mere coincidence that the Gautam Adani-promoted Adani Ports and Special Economic Zone announced its Rs 5,500-crore purchase of Dhamra Port on May 16, 2014, the day Narendra Modi won the last general election.

The deal, in the making for over two years, was stuck over environment clearance for expanding the port's capacity to 100 million tonnes. The clearance was a pre-condition for the deal with erstwhile owners Tata Steel and Larsen & Toubro that arrived at the fag end of the United Progressive Alliance regime.

Since then, Adani's appetite for acquisitions has grown. In August 2014, Adani Power acquired a 1,200 Mw thermal power plant at Udupi for Rs 6,000 crore from Lanco Infratech. It followed this up with a Rs 4,200 crore acquisition of a 600 Mw thermal power plant at Korba West from the Avantha Group. (A LOOK AT THE BOOKS)

Adani Power's debt rose from Rs 44,742 crore in March 2015 to Rs 48,477 crore in September 2015 and its debt-equity ratio stood at an alarming 8.4 on account of the Udupi plant's acquisition. The ratio is expected to deteriorate once the the Korba West acquisition is completed in the December quarter. Its debt was, respectively, 7.25 times higher than equity at the end of March 2015 and 2.75 times higher than equity in March 2011. Consequently Adani Power's market value also fell to Rs 7,251 crore at the end of September from Rs 13,584 crore in March 2015 and Rs 24,590 crore in March 2011.

"They should tell investors what their targeted debt-equity is and how they plan to achieve it," says Amit Tandon, managing director at Mumbai-based proxy advisory firm Institutional Investor Advisory Services

Adani Power did not respond to queries but its annual report for the last financial year states, "The company has delayed repayment of two principal installments amounting to Rs 150 crore each by 53 days and 30 days, respectively, to a bank during the year." This is the period during which it made acquisitions worth Rs 10,200 crore.

Investors are worried by these acquisitions because Adani Power has been making losses for the past four years, and analysts expect the company will report a loss in 2015-16. "A slow ramp-up of production from the group's captive mine, poor fuel security, a depreciated rupee, project cost overruns and fixed tariffs translate into an unsustainable earnings model," says Sumit Kishore, analyst at JP Morgan Securities.

Adani Power reported a loss of Rs 786 crore in the six months ending September 2015 even though it recognised Rs 1,500 crore income in lieu of compensatory tariff from its plants at Mundra (Gujarat), Tiroda (Maharashtra) and Kawai (Rajasthan). All the compensatory tariff cases are being heard by the Appellate Tribunal for Electricity or the Supreme Court. The company's cumulative compensatory tariff is now Rs 5,740 crore, which is higher than its net worth of Rs 5,205 crore. "Full retrospective recovery of compensatory tariff has to be managed by Adani Power to avoid future write-off of substantial receivables," says Kishore from J P Morgan Securities.

Despite these worries the group has not slowed its acquisitions. Adani Power is again in discussions with the Avantha Group for the purchase of its 1,260 Mw plant in Madhya Pradesh. It has entered into a 50:50 joint venture with the government of Rajasthan to set up a 10 Gw solar power park at an estimated investment of Rs 59,400 crore. Adani Power has also signed a memorandum of understanding with the Chhattisgarh government to invest Rs 26,400 crore in two projects. It also plans to set up two coal-fired plants with a capacity of 1,600 Mw in Bangladesh with a capital cost of Rs 9,900-13,200 crore. Its objective is to reach 20 Gw of capacity by 2020.

Similar aggression is evident in other group firms as well. Adani Ports and Special Economic Zone has agreed to buy L&T Shipbuilding's port at Kattupalli in Tamil Nadu for about Rs 2,000 crore. It is also in talks to acquire the DVS Raju-controlled Gangavaram Port in Andhra Pradesh for Rs 13,000 crore and Essar Ports, which could be worth Rs 15,000 crore.

Adani Ports had a debt of Rs 17,186 crore at the end of September and its debt-equity ratio has been a relatively comfortable 1.5-1.6 since the end of 2013-14. Its balance sheet has weakened since 2010-11 when its debt was 0.9 times equity. With the acquisition of Kattupalli port, this is expected to weaken further. However, Adani Ports' net profit jumped to Rs 2,314 crore in 2014-15 from Rs 918 crore in 2010-11. Consequently, its market capitalisation, too, spurted from Rs 27,336 crore to Rs 63,767 crore in the same period. For the six months ended September 2015, it reported a net profit of Rs 1,308 crore.

"We believe the incremental port assets that Adani Ports is getting into are not as value-accretive as Mundra, though they may offer strategic advantages for the Adani Group overall," said Amar Kedia, analyst at Nomura Securities in a note.

Adani's acquisition spree is not restricted to these two companies. Adani Enterprises last month announced it was buying its partner's 49 per cent stake in Chemoil Adani, a Singapore-based joint venture with Chemoil Energy, for an undisclosed amount. The company supplies bunker fuel to vessels at Mundra and Adani's other ports. It had a market cap of $521 million before being delisted from the Singapore Stock Exchange in May last year. At that time, Adani's 49 per cent stake was valued at $260 million (Rs 1,560 crore).

Till the last financial year, when Adani Enterprises was holding other group firms, it had Rs 83,570 crore debt, 3.1 times its equity. But it de-merged Adani Power and Adani Ports along with Adani Transmissions in June. Now Adani Enterprises consists of the group's coal (trading and mining), agri-processing, infrastructure and city gas distribution businesses. After the demerger, Adani Enterprises' debt declined to Rs 18,567 crore at the end of September, which was just 1.24 times its equity. But the company has been facing issues at its $4.2 billion (Rs 27,720 crore) Carmichael coal mine in Australia, where delayed environmental clearance has raised the project's cost by 20 per cent.

Adani Enterprises needs to spend $7.7 billion (Rs 50,820 crore) over the next three years at Carmichael mine - $4.2 billion to get the mine operational and another $3.5 billion to set up the rail link to Abbott Point and a terminal to transport 60 million tonnes of coal once the mine is operating at full capacity.

Adani Transmission reported Rs 182 crore net profit for the six months ending September 2015. This newly created company has not made any acquisition but still had Rs 7,777 crore debt at the end of September and the highest debt-equity in the group at nearly 10 times.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 26 2015 | 12:48 AM IST