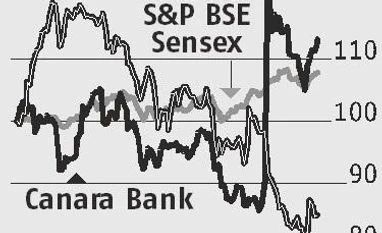

Canara Bank: Asset sale to reduce capital needs

Life insurance, housing finance, asset management key non-core assets

)

premium

Compiled by BS Research Bureau

Canara Bank has been among the proactive public sector banks (PSBs) to dispose its non-core assets, to shore up its capital position. While it ranks fourth in terms of holding non-core assets, trailing peers such as State Bank of India (SBI), Punjab National Bank (PNB) and IDBI, analysts at Antique Stock Broking indicate Canara Bank’s non-core assets can reduce its capital requirement needs by 30 per cent.

The Street pegs the bank’s non-core assets could add up 30–32 per cent of Canara Bank’s market capitalisation (m-cap). In fact, its capital raising efforts has helped it increase tier-1 capital from 10.8 per cent in June 2016 to 12.5 per cent in Sepetember 2017.

The key asset for monetisation is Can Fin Homes, its listed housing finance company (HFC), which commands an m-cap of Rs 6,200 crore.

The Street pegs the bank’s non-core assets could add up 30–32 per cent of Canara Bank’s market capitalisation (m-cap). In fact, its capital raising efforts has helped it increase tier-1 capital from 10.8 per cent in June 2016 to 12.5 per cent in Sepetember 2017.

The key asset for monetisation is Can Fin Homes, its listed housing finance company (HFC), which commands an m-cap of Rs 6,200 crore.

Compiled by BS Research Bureau