Jewellery helps Titan become third-most valuable Tata firm

With key growth driver, jewellery business Tanishq, excelling in Q2, firm posted its biggest single-day gain of 19%

)

premium

Until a decade ago, watches were Titan’s bread and butter, accounting for about half its revenues. But still, Titan, for all its appeal, wasn’t among the top-ranking companies in market value for the Tata group. Even though Titan is now India’s largest-selling watch brand, it is the jewellery business which has changed the company’s fortunes in the past few years.

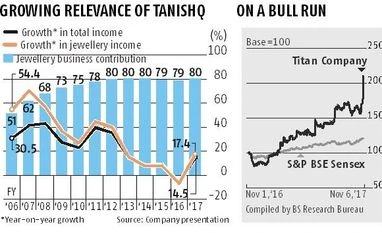

Monday’s 19 per cent gain in Titan’s stock price, which adds to the strong rally seen this calendar year, made Titan the third most-valuable company in the Tata group. This, itself, is a statement of how important the company has emerged. The Titan stock surged past Tata Steel and is now behind the group’s flagship Tata Consultancy Services (TCS) and Tata Motors in market value.

Incidentally, Tata Steel is one of Tata’s oldest businesses and generates revenues five times larger than that of Titan. Yet, with Monday’s market cap of Rs 69,651 crore, Titan surpassed Tata Steel’s Rs 68,834 crore of market cap.

Titan’s promotion to this league, in a way, reiterates investors’ preference for consumer-oriented stocks, particularly those which are successfully withstanding the test of formalisation. In fact, ace investor Rakesh Jhunjhunwala was among the early ones to identify the potential in Titan.

The growing relevance of Titan’s gold business has changed things for the best. Even for the September quarter’s (Q2’s) stellar performance, all credit went to Titan’s jewellery business, which exceeded expectations.

While Q2 is usually propped up by festive and marriage season demand, analysts anticipated the current year’s Q2 would be relatively subdued due to Prevention of Money Laundering Act (PMLA) becoming applicable for jewellers. Accordingly, jewellers were required to furnish detail of their customer’s permanent account number (PAN) for purchases exceeding Rs 50,000. Notwithstanding this, the jewellery division’s revenues rose 36 per cent to Rs 2,711 crore, lifting Titan’s Q2 revenues by 30 per cent to Rs 3,376 crore.

Monday’s 19 per cent gain in Titan’s stock price, which adds to the strong rally seen this calendar year, made Titan the third most-valuable company in the Tata group. This, itself, is a statement of how important the company has emerged. The Titan stock surged past Tata Steel and is now behind the group’s flagship Tata Consultancy Services (TCS) and Tata Motors in market value.

Incidentally, Tata Steel is one of Tata’s oldest businesses and generates revenues five times larger than that of Titan. Yet, with Monday’s market cap of Rs 69,651 crore, Titan surpassed Tata Steel’s Rs 68,834 crore of market cap.

Titan’s promotion to this league, in a way, reiterates investors’ preference for consumer-oriented stocks, particularly those which are successfully withstanding the test of formalisation. In fact, ace investor Rakesh Jhunjhunwala was among the early ones to identify the potential in Titan.

The growing relevance of Titan’s gold business has changed things for the best. Even for the September quarter’s (Q2’s) stellar performance, all credit went to Titan’s jewellery business, which exceeded expectations.

While Q2 is usually propped up by festive and marriage season demand, analysts anticipated the current year’s Q2 would be relatively subdued due to Prevention of Money Laundering Act (PMLA) becoming applicable for jewellers. Accordingly, jewellers were required to furnish detail of their customer’s permanent account number (PAN) for purchases exceeding Rs 50,000. Notwithstanding this, the jewellery division’s revenues rose 36 per cent to Rs 2,711 crore, lifting Titan’s Q2 revenues by 30 per cent to Rs 3,376 crore.