GST slashed on 29 items, 54 services; return filing to be simpler

The changes will be effective from January 25; 15 states to start intra-state e-way bill from February 1

)

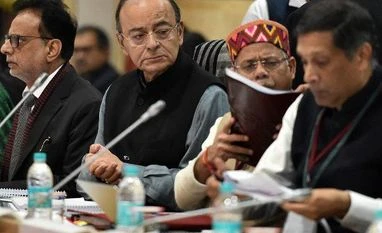

Union Finance Minister Arun Jaitley at a GST meeting at Vigyan Bhavan, in New Delhi (Photo: PTI)

The GST Council will cut rates on some products and services under the goods and services tax (GST), the finance minister said on Thursday, in a bid to encourage greater compliance as revenues have dipped since the landmark reform was announced in July.

The panel, headed by Finance Minister Arun Jaitley and comprising representatives of all states, at its 25th meeting today decided to reduce tax rate on 29 items and 54 categories of services with effect from January 25.

The Council veered around the idea of making the GST return filing process simpler to ease compliance burden for small businesses.

GST Panel also decided to divide Rs 350 billion (Rs 35,000 crore) IGST collections between centre and states.

GST Panel also decided to divide Rs 350 billion (Rs 35,000 crore) IGST collections between centre and states.

Briefing reporters after the meeting, Jaitley said the next meeting of the Council may consider bringing items like crude oil, natural gas, petrol, diesel, ATF and real estate within the GST purview.

In a bid to ease compliance burden, the Council veered around to the idea of registered entities continuing to file the return in GSTR 3B Form while moving to a system where supplier invoice captures details of the transaction.

The new process would be finalised in the next meeting of the GST Council after a written formulation is circulated to the states, he said.

The date of the next meeting of the Council has not yet been decided, he said.

Jaitley said the GST provision requiring transporters to carry an electronic way bill or e-way bill, when moving goods of over Rs 50,000 in value between states, will be implemented from February 1 to check rampant tax evasion.

As many as 15 states have decided to implement the provision for intra-state movements as well, he said.

After implementation of the Goods and Services Tax (GST) from July 1, the requirement of carrying e-way bill was postponed pending IT network readiness.

Once the e-way bill system is implemented, tax avoidance will become extremely difficult as the government will have details of all goods above the value of Rs 50,000 moved and can spot the mismatch if either the supplier or the purchaser does not file tax returns.

Businesses have raised concerns about high rates of taxation and cumbersome processes in GST, billed as India's biggest tax reform in 70 years.

Asia's third-largest economy faces the risk of missing its fiscal deficit target in the current fiscal year as lower revenue collection from slowing economic growth and teething troubles with value-added tax launched in July hit the economy.

The goods on which GST will be lowered include biofuel-run buses, used motor vehicles and diamonds and precious stones.

Tax on sales of liquefied petroleum gas by private firms for domestic use has been reduced to 5 per cent from 18 per cent.

In the services segment, India will cut taxes on transportation of crude, gasoil, gasoline, jet fuel and services relating to mining, exploration and drilling of oil and natural gas, among other things.

The South Asian nation's tax collection plunged after GST was implemented in July, which hit the economy and complicated tax filings for business.

The country's tax indirect tax collections have been falling since the launch of GST, reducing to Rs 808.08 billion ($12.66 billion) in November from Rs 940.63 billion in July.

Admission to theme parks, water parks, joy rides, merry-go-rounds, go-carting and ballet will now be taxed at 18% instead of 28% and on common effluent treatment plans services from 18% to 12%.

8:03 PM

GST Council decided to raise rates on cigarette filter rods from 12% to 18%.

7:49 PM

GST Council cuts tax rate on domestic LPG by private companies to 5% from 18% earlier.

7:48 PM

GST Council cuts cess on vehicles for ambulance to 0% from 15% earlier.

7:47 PM

GST Council cuts tax rate on mining, drilling of natural gas to 12%

7:46 PM

GST Council cuts tax rate on velvet fabric to 5% from 12% earlier.

7:46 PM

GST Council cuts tax rate on drip irrigation system, mechanical sprayer to 12% from 18%.

7:44 PM

Council cuts GST on mehendi cones to 5% from 18% earlier

7:43 PM

GST Council cuts rates on sugar boiled confectionery to 12% from 18% earlier.

7:39 PM

GST Council cuts tax rate on bio-diesel to 12% from 18% earlier.

Topics :

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 18 2018 | 9:29 PM IST