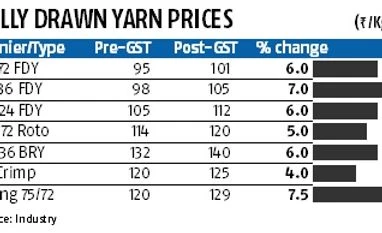

Weavers reel under post-GST hike in yarn prices

The price hike has been caused by rising raw material prices such as PTA and MEG

)

However, at a time when several weavers, processors and traders are yet to register under GST, along with lack of clarity over accumulated duty credit and the reverse charge mechanism (RCM), decentralised powerlooms and textile processing units are finding it tough to sustain under rising input costs.

"There is still uncertainty in the industry since registration process is still going on. Weavers, processors and traders are not in the position to buy or sell. At such a time, a price hike in raw materials is having a significant impact on our input costs as well as margins," said Ashish Gujarati, president of Pandesara Weavers' Association in Surat.

Unlike the pre-GST prices, the post-GST ones will see an additional 18 per cent levy on powerlooms and processors, which the latter have to claim through input tax credit. However, on account of excess input credit accumulation and the RCM, due to lack of registered job workers in the value chain, powerlooms and processors have to bear the additional cost themselves. Hence, a Rs 2 per kg hike in yarn prices will attract an additional 18% tax, which for now might not be got back through input credit.