Rupee to weaken in run-up to Budget as corporates increase $ buying

Experts believe it can touch 63 against the dollar, which has been strengthening against a basket of currencies

)

Analysts expect the rupee to weaken in the run-up to the Budget with corporates, especially importers, increasing their dollar-buying from the market. The Indian currency is already trading weak, having breached the 62-mark. Experts believe it can touch 63 against the dollar, which has been strengthening against a basket of currencies.

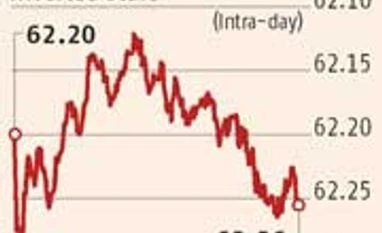

On Wednesday, the rupee ended weak for the third straight trading session to end at a one-month low of 62.26 against the dollar, compared to the previous close of 62.20. The rupee had opened at 62.27 and, during intra-day trades, touched a low of 62.30. The Indian currency had ended at 62.33 on January 9.

Read our full coverage on Union Budget

“Corporates are booking their import exposures ahead of the Budget. The trend for the rupee is towards weakening due to which whatever open position they have, they have to hedge that. Going forward, even government debt payments may come up due to which the rupee can breach the 62.40-62.50 levels,” said Sandeep Gonsalves, forex consultant and dealer at Mecklai & Mecklai.

Currency dealers expect the US Fed to start increasing interest rates sometime in 2015 with the US economy showing signs of recovery on the back of the dollar strengthening against a basket of global currencies.

“Importers will buy to cover their exposures as the dollar stays strong. We can see the dollar demand from importers increasing going forward ahead of the Budget. The volatility can be high after the Budget. The rupee is seen trading in the range of 61.70 to 63 till the Budget. The bias is towards 63,” said Anindya Banerjee, currency analyst at Kotak Securities.

The other factor which is leading to weakness in the rupee is that the Reserve Bank of India has been mopping up dollar flows attracted by domestic markets.

RBI has been doing so because it is believed that when the US starts increasing interest rates, the foreign investors will start pulling out from emerging markets such as India, as a result of which the rupee might be vulnerable against the dollar.

The latest RBI data show that foreign exchange reserves rose to an all-time high of $327.88 billion for the week ending January 30, 2015.

Raising concerns on corporates' unhedged foreign exchange exposure, RBI deputy governor H R Khan had on Tuesday urged them to manage the potential risks associated with their exposures.

“Regulators certainly will not like to micro manage what otherwise is a commercial decision; corporates need to take care of the potential risks embedded in their unhedged currency exposures since they might incur significant costs due to unexpected and sudden exchange rate movements," Khan had said.

On Wednesday, the rupee ended weak for the third straight trading session to end at a one-month low of 62.26 against the dollar, compared to the previous close of 62.20. The rupee had opened at 62.27 and, during intra-day trades, touched a low of 62.30. The Indian currency had ended at 62.33 on January 9.

Read our full coverage on Union Budget

“Corporates are booking their import exposures ahead of the Budget. The trend for the rupee is towards weakening due to which whatever open position they have, they have to hedge that. Going forward, even government debt payments may come up due to which the rupee can breach the 62.40-62.50 levels,” said Sandeep Gonsalves, forex consultant and dealer at Mecklai & Mecklai.

“Importers will buy to cover their exposures as the dollar stays strong. We can see the dollar demand from importers increasing going forward ahead of the Budget. The volatility can be high after the Budget. The rupee is seen trading in the range of 61.70 to 63 till the Budget. The bias is towards 63,” said Anindya Banerjee, currency analyst at Kotak Securities.

The other factor which is leading to weakness in the rupee is that the Reserve Bank of India has been mopping up dollar flows attracted by domestic markets.

RBI has been doing so because it is believed that when the US starts increasing interest rates, the foreign investors will start pulling out from emerging markets such as India, as a result of which the rupee might be vulnerable against the dollar.

The latest RBI data show that foreign exchange reserves rose to an all-time high of $327.88 billion for the week ending January 30, 2015.

Raising concerns on corporates' unhedged foreign exchange exposure, RBI deputy governor H R Khan had on Tuesday urged them to manage the potential risks associated with their exposures.

“Regulators certainly will not like to micro manage what otherwise is a commercial decision; corporates need to take care of the potential risks embedded in their unhedged currency exposures since they might incur significant costs due to unexpected and sudden exchange rate movements," Khan had said.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 12 2015 | 12:38 AM IST