Trading volumes surge in government bonds

Attracted by rise in yields since beginning of FY15

)

Trading volumes in the government securities market has jumped by 200 per cent since the start (from April 1) of the new financial year.

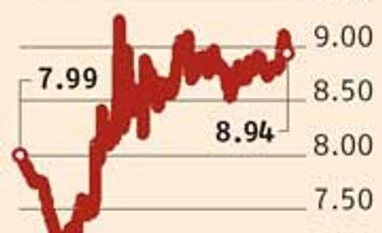

Investors see value in the paper, helping the yields to soften from a high of 9.1 per cent. Earlier this month, the yield on the 10-year benchmark government bond breached nine per cent, which attracted buyers.

According to data from Clearing Corporation of India, the trading volume in government bonds grew to Rs 40,240 crore on April 11 from Rs 13,459 crore on April 2. That in the 10-year benchmark government bond rose to Rs 24,170 crore on April 11 from Rs 6,771 crore on April 2.

The yield on the 10-year benchmark ended at 8.96 per cent on April 2 but rose to 9.1 per cent on April 7, the highest for benchmark 10-year notes since November 22. On Friday, the yield ended at 8.94 per cent.

“The yields went up very fast in a few trading sessions. The market felt there was value in buying the bonds. The yield level above nine per cent attracted buyers,” said Mohan Shenoi, president, group treasury and global markets, Kotak Mahindra Bank. He said there was significant supply pressure every month due to the bond auctions.

This week, the Reserve Bank of India (RBI) will auction government bonds for a notified amount of Rs 20,000 crore. For the financial year’s first half (April-September), it plans to auction bonds worth Rs 3.68 lakh crore. “By our internal assessment, there is a Rs 140,000-crore gap between demand and supply for the entire financial year. This is taking into account net state loans, net treasury bills and net government borrowings,” said Shenoi. “Assuming banking sector deposit growth at 15 per cent this financial year and assuming banks will not invest more than 23 per cent in Statutory Liquidity Ratio and assuming some foreign institutional investor inflows into long-term bonds and insurance companies buying of bonds, this mismatch can be breached only through open market operations (OMOs). But RBI might not do OMOs. Therefore, this would put sustained pressure on yields. Till month-end, the yield on the 10-year bond might trade in the range of 8.9 to 9.1 per cent.”

The Consumer Price Index (CPI)-based inflation data is expected this week and there are concerns in the market that it would show a rise for March. This might result in the 10-year bond yield again breaching nine per cent. “If the yield rises from here, then traders who missed the (earlier) opportunity might start buying. Buying will again emerge at the 9.05 per cent yield level,” said Siddharth Shah, vice-president, STCI Primary Dealer.

Retail inflation eased more than expected to a 25-month low of 8.1 per cent in February, helped by moderating food prices.

Investors see value in the paper, helping the yields to soften from a high of 9.1 per cent. Earlier this month, the yield on the 10-year benchmark government bond breached nine per cent, which attracted buyers.

According to data from Clearing Corporation of India, the trading volume in government bonds grew to Rs 40,240 crore on April 11 from Rs 13,459 crore on April 2. That in the 10-year benchmark government bond rose to Rs 24,170 crore on April 11 from Rs 6,771 crore on April 2.

ALSO READ: Bonds record biggest weekly gain since Jan

“The yields went up very fast in a few trading sessions. The market felt there was value in buying the bonds. The yield level above nine per cent attracted buyers,” said Mohan Shenoi, president, group treasury and global markets, Kotak Mahindra Bank. He said there was significant supply pressure every month due to the bond auctions.

The Consumer Price Index (CPI)-based inflation data is expected this week and there are concerns in the market that it would show a rise for March. This might result in the 10-year bond yield again breaching nine per cent. “If the yield rises from here, then traders who missed the (earlier) opportunity might start buying. Buying will again emerge at the 9.05 per cent yield level,” said Siddharth Shah, vice-president, STCI Primary Dealer.

Retail inflation eased more than expected to a 25-month low of 8.1 per cent in February, helped by moderating food prices.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 15 2014 | 12:47 AM IST