Coal India shares slip over 4.5% as disinvestment nears

Marketmen say heavy selling seen on concerns that govt would sell the stock cheaper while divesting

)

Coal India shares fell 4.5 per cent on Monday, as investors dumped the stock ahead of the government’s move on divesting its holding in the company.

Market players said heavy selling was seen in the counter in anticipation that the stock would be sold cheaper during the sale by the government.

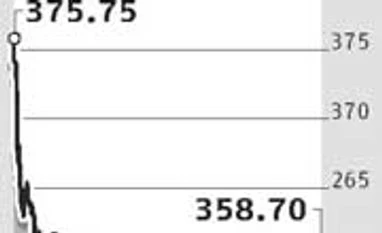

Shares of the company ended 4.5 per cent lower at Rs 358.7 from previous close of Rs 375.75, wiping Rs 11,000 crore of market value. Coal India and Oil and Natural Gas Corporation (ONGC) are expected to be the two big disinvestments for the current financial year.

“...in the next two-and-half months, (the government) is going about disinvestment in more than one company, which is going to be our priority,” Finance Minister Arun Jaitley was quoted as saying on the sidelines of the Vibrant Gujarat Summit in Gandhinagar.

Shorting shares ahead of disinvestment to apply later at a cheaper rate is a common strategy used by traders, say market players. So far this financial year, the Centre, which has set a disinvestment target of Rs 43,000 crore, has divested in five per cent in Steel Authority of India for Rs 1,700 crore.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 12 2015 | 10:45 PM IST