Deepak Fertilisers in a sweet spot

Recent stake buy in Mangalore Chemicals by the company is viewed positively by the market, given the synergies and valuations

)

After the Zuari group picked up 10 per cent stake in the Vijay Mallya group company Mangalore Chemicals & Fertilizers (MCF), Deepak Fertilisers, too, has evinced interest in the fertiliser and urea producer. Last Wednesday, it brought 24.46 per cent stake from the open market at Rs 61.75 a share worth Rs 179 crore. The move is seen in a positive light for shareholders of both, Deepak Fertilisers as well as MCF.

While there are synergies for Deepak Fertilisers, for MCF the association with Deepak will give it scale, larger reach, cost benefits and strengthen its balance sheet, given the high debt-equity ratio of 2.07 times. The gains for its shareholders could be more in the event of a fight between Zuari and Deepak over acquisition of MCF which could lead to higher share price.

For now though, the Zuari group has reportedly said it is not interested in bidding for MCF; they are looking at capital gains on their investments. Zuari has bought MCF stake at around Rs 38 a share.

What MCF means for Deepak Fertilisers

It will help Deepak Fertilisers to strengthen its position in the fertiliser space with increase in capacity, reach and product range. The company currently has a capacity to produce about 180,000 tonnes of complex fertilisers. In comparison, MCF has 260,000 tonnes complex fertiliser capacity and another 380,000 tonnes urea capacity. Deepak Fertilisers, which is largely present in North and West Indian markets, will also get a foot-hold in Karnataka, Andhra Pradesh and Tamil Nadu, where Mangalore Chemicals has a strong position.

“Increase in capacity would be positive for raw material cost negotiations. Also, geographical spread and surplus land are investment positives in the long term,” says Satish Mishra analyst with HDFC Securities. Deepak Fertilisers had Rs 102 crore cash and 0.7 times net debt to equity as on March. Hence, there will be no significant stretch on the balance sheet, adds Mishra.

Has Deepak Fertilisers paid excess?

At Rs 61.75, MCF’s equity is valued at Rs 732 crore. This is 11 times its standalone earnings in FY13, which is reasonable considering RoE (return on equity) of about 12 per cent. Although the debt-equity ratio is high, MCF has sufficient assets (net current assets of Rs 1,165 crore and investments of Rs 200 crore) as on March 31. Considering its debt balance and adjusting for the cash in the books and advances to the government, the enterprise value works out to around of Rs 850 crore, a reasonable four times its operating profits.

Analysts also believe that the valuations should be looked from the viewpoint that MCF also has surplus land of about 50 acres, which they believe is sufficient for building a plant with one million tonne capacity in the future as and when needed. However, any attempt to pay a significantly higher price could change the equations for Deepak Fertilisers.

The road ahead

In the coming months, investors could see more activity in the Mangalore Chemicals’ counter considering that the UB group still holds about 22 per cent as at end-March. Although 57.38 per cent of this holding is pledged with borrowers, Mallya might still look for a higher price in case of acquisition by the interested parties.

For now, it should provide a floor to the share price, which had ranged Rs 30-40 since January this year. From the perspective of shareholders of Deepak Fertilisers, analysts view this acquisition with a positive note given the synergies and reasonable valuations.

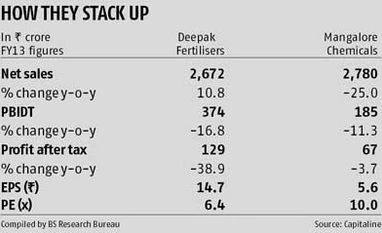

Though Deepak Fertilisers’ FY13 performance has not been good, analysts see an improvement in FY14.

“Having witnessed sharp erosion in Ebitda margin during FY13, Deepak Fertilisers expects its chemical business margin to improve 300-400 basis points in the coming quarters led by the recent correction in raw material prices. At current market price, the stock continues to trade at attractive valuations and dividend yield of six per cent. We have a buy rating with a target price of Rs 145 a share based, which is based on 6.5 times FY14 estimated EPS,” said Manish Mahawar, analyst at Edelweiss Securities.

While there are synergies for Deepak Fertilisers, for MCF the association with Deepak will give it scale, larger reach, cost benefits and strengthen its balance sheet, given the high debt-equity ratio of 2.07 times. The gains for its shareholders could be more in the event of a fight between Zuari and Deepak over acquisition of MCF which could lead to higher share price.

For now though, the Zuari group has reportedly said it is not interested in bidding for MCF; they are looking at capital gains on their investments. Zuari has bought MCF stake at around Rs 38 a share.

What MCF means for Deepak Fertilisers

It will help Deepak Fertilisers to strengthen its position in the fertiliser space with increase in capacity, reach and product range. The company currently has a capacity to produce about 180,000 tonnes of complex fertilisers. In comparison, MCF has 260,000 tonnes complex fertiliser capacity and another 380,000 tonnes urea capacity. Deepak Fertilisers, which is largely present in North and West Indian markets, will also get a foot-hold in Karnataka, Andhra Pradesh and Tamil Nadu, where Mangalore Chemicals has a strong position.

“Increase in capacity would be positive for raw material cost negotiations. Also, geographical spread and surplus land are investment positives in the long term,” says Satish Mishra analyst with HDFC Securities. Deepak Fertilisers had Rs 102 crore cash and 0.7 times net debt to equity as on March. Hence, there will be no significant stretch on the balance sheet, adds Mishra.

Has Deepak Fertilisers paid excess?

At Rs 61.75, MCF’s equity is valued at Rs 732 crore. This is 11 times its standalone earnings in FY13, which is reasonable considering RoE (return on equity) of about 12 per cent. Although the debt-equity ratio is high, MCF has sufficient assets (net current assets of Rs 1,165 crore and investments of Rs 200 crore) as on March 31. Considering its debt balance and adjusting for the cash in the books and advances to the government, the enterprise value works out to around of Rs 850 crore, a reasonable four times its operating profits.

Analysts also believe that the valuations should be looked from the viewpoint that MCF also has surplus land of about 50 acres, which they believe is sufficient for building a plant with one million tonne capacity in the future as and when needed. However, any attempt to pay a significantly higher price could change the equations for Deepak Fertilisers.

In the coming months, investors could see more activity in the Mangalore Chemicals’ counter considering that the UB group still holds about 22 per cent as at end-March. Although 57.38 per cent of this holding is pledged with borrowers, Mallya might still look for a higher price in case of acquisition by the interested parties.

For now, it should provide a floor to the share price, which had ranged Rs 30-40 since January this year. From the perspective of shareholders of Deepak Fertilisers, analysts view this acquisition with a positive note given the synergies and reasonable valuations.

Though Deepak Fertilisers’ FY13 performance has not been good, analysts see an improvement in FY14.

“Having witnessed sharp erosion in Ebitda margin during FY13, Deepak Fertilisers expects its chemical business margin to improve 300-400 basis points in the coming quarters led by the recent correction in raw material prices. At current market price, the stock continues to trade at attractive valuations and dividend yield of six per cent. We have a buy rating with a target price of Rs 145 a share based, which is based on 6.5 times FY14 estimated EPS,” said Manish Mahawar, analyst at Edelweiss Securities.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jul 08 2013 | 10:46 PM IST