Guar price trends concern traders

Pre-monsoon rainfall intensifies sowing, amid uncertain demand

)

The high volatility in guar prices ahead of the peak sowing season have caused worry over the relaunch of its futures trading on commodity exchanges.

With the onset of rain ahead of the actual monsoon season, guar seed sowing has intensified. Experts believe 15-20 per cent has been completed.

But, falling prices in the spot and futures market have worried farmers and traders. Guar seed prices for the near-month contract hit Rs 5,700 a quintal early this month, before closing with the upper circuit at Rs 7,010 a qtl today.

The price fall below Rs 5,500 a qtl would lead to farmers diversifying to other more remunerative crops, including edible oils, pulses and cotton. Vikas WSP, the only listed and organised entity in the segment, had earlier contracted with farmers to grow the seed extensively, promising to buy at Rs 10,000 a qtl. The falling prices, due to lower export demand of its derivative, guar gum, has forced it to do a rethink. Repeated efforts to reach B D Agarwal, managing director, were unsuccessful. Traders, however, say the company is no longer a buyer of guar seed, resulting in over half of last years output still remaining with farmers and stockists.

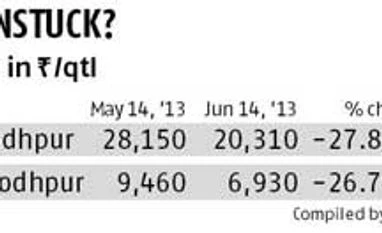

Also, the pre-monsoon showers have raised this years output prospects. Additionally, increased seed arrivals due to a bumper summer harvest in Gujarat have led to a 16 per cent fall in guar prices in the past three weeks.

Purshotam Mundra, partner in Rajendra Prashad Purshotam Mundra, a Jodhpur-based guar trader, estimates output at 275,000 bags (a bag is 100 kg) this year as against 225,000 bags last year.

Sanjay Periwal, another Jodhpur-based trader, says guar gum demand from abroad is negligible, pulling down prices of both guar and its derivatives.

Trading in these two commodities is under continuous supervision of the Forward Markets Commission (FMC) and the ministry of consumer affairs. In March 2012, the FMC had discontinued futures trading in guar contracts, following price manipulation by several trader groups.

Currently, there is no bullish or bearish activity in guar counters. The current price fall is purely based on fundamentals. While seed prices fell because of excessive supplies, gum faced irregular export orders, said Purushottam Isaria, president of the All India Guargum Manufacturers Association.

While sowing of the winter harvest crop begins in June in most states, it commences in July from Rajasthan. Isaria said farmers expected 25 per cent higher sowing and a proportionate rise in guar seed output this season.

Mundra believes guar gum is being imported by the US on a cautious note. Instead of one-time bulk orders as in previous years, importers have started ordering small quantities.

With the onset of rain ahead of the actual monsoon season, guar seed sowing has intensified. Experts believe 15-20 per cent has been completed.

But, falling prices in the spot and futures market have worried farmers and traders. Guar seed prices for the near-month contract hit Rs 5,700 a quintal early this month, before closing with the upper circuit at Rs 7,010 a qtl today.

The price fall below Rs 5,500 a qtl would lead to farmers diversifying to other more remunerative crops, including edible oils, pulses and cotton. Vikas WSP, the only listed and organised entity in the segment, had earlier contracted with farmers to grow the seed extensively, promising to buy at Rs 10,000 a qtl. The falling prices, due to lower export demand of its derivative, guar gum, has forced it to do a rethink. Repeated efforts to reach B D Agarwal, managing director, were unsuccessful. Traders, however, say the company is no longer a buyer of guar seed, resulting in over half of last years output still remaining with farmers and stockists.

Also, the pre-monsoon showers have raised this years output prospects. Additionally, increased seed arrivals due to a bumper summer harvest in Gujarat have led to a 16 per cent fall in guar prices in the past three weeks.

Sanjay Periwal, another Jodhpur-based trader, says guar gum demand from abroad is negligible, pulling down prices of both guar and its derivatives.

Trading in these two commodities is under continuous supervision of the Forward Markets Commission (FMC) and the ministry of consumer affairs. In March 2012, the FMC had discontinued futures trading in guar contracts, following price manipulation by several trader groups.

Currently, there is no bullish or bearish activity in guar counters. The current price fall is purely based on fundamentals. While seed prices fell because of excessive supplies, gum faced irregular export orders, said Purushottam Isaria, president of the All India Guargum Manufacturers Association.

While sowing of the winter harvest crop begins in June in most states, it commences in July from Rajasthan. Isaria said farmers expected 25 per cent higher sowing and a proportionate rise in guar seed output this season.

Mundra believes guar gum is being imported by the US on a cautious note. Instead of one-time bulk orders as in previous years, importers have started ordering small quantities.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 14 2013 | 11:21 PM IST