Key Nifty levels to watch are 7,450 and 7,700

)

Bullish rumours centred on the Budget could keep sentiment buoyant until July 10. As such, the market is ignoring bad news on the monsoon front and also shrugging off worrying externals like fighting in Iraq. Foreign institutional investors (FIIs) remain net buyers. Retail sentiment is also strong. But there is ample cause for volatility and we could see major daily swings. Most indicators also suggest the market is over-bought. However, the indicators have been reading overbought since the election results came in.

The current short-term and medium-term trends are indeterminate. The long-term trend is bullish, of course. The intermediate trend appears to be going sideways. There is support at Nifty 7,450-7,500 and also at 7,550 zone. There is strong resistance at 7,650-7,700. The index is bouncing between these levels.

A breakout to a new all-time high above 7,700 or a drop below 7,450 could help to define the short-term trend. While there's support at every 50-points, a fall below 7,450 could mean a drop to 7,300 or lower.

Apart from Budget-related rumours, which are generally bullish in nature, volatility could be focussed on the energy sector. The Iraq situation is not going to be resolved quickly. This means crude prices (and to some extent, gas prices) will fluctuate with the fortunes of war. There will be high volatility across energy stocks. A poor start to the monsoon, with major rainfall deficiency also makes food inflation likely. This could put pressure on the financial sector.

Balancing negatives, there are strong expectations of reform on the oil subsidy front and also rumours of some reshuffling in the way the government maintains its control of public sector banks. At least until the budget, the rumours could keep the Bank Nifty afloat and also buoy up energy stocks. Selling pressure on the rupee can probably be managed without much trouble. A lower rupee could even be useful in that it would boost exports. The IT sector could perform its customary role as a hedge against a lower rupee.

Underlying sentiment is very positive. Small caps and midcaps have comfortably outperformed the large caps. All this means however, is that retail is strongly positive. Relying upon retail sentiment will be dangerous if there is FII selling. If the Budget is read as positive, institutional support will be forthcoming. If the Budget is read as disappointing, there could be a stampede for the exit.

Premia on the Nifty option chain is extremely high, reflecting expectations of high volatility. Open interest also implies that traders are braced for a move till either 6,900-7,000 or till 8,000-8,100 within the next 10 sessions. The put-call ratios (PCR) are bearish at around 0.9 PCR for both the July settlement and for the next three months.

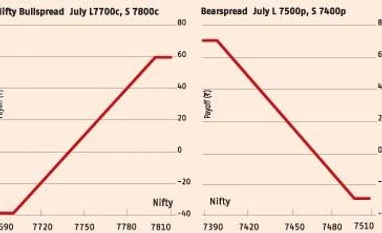

A straddle at 7,600 (with spot Nifty at 7,612) is very expensive, costing 308, with 7,600c (170) and 7,600p (138). It is also skewed with puts much cheaper. A bullspread of long 7,700c (119) and short 7,800c (79) costs 40 and pays a maximum 60. This is expensive given distance from money. A bearspreasd of long 7,500p (99) and short 7,400p (67) costs 32 and pays 68. This is also expensive. Taking long strangles also look unprofitable. A trader might want to combine a short 7,700c, short 7,500p with a long 7,800c and long 7,400p. This receives 217 on short premium and pays 146 for the long positions. The net received of 71 would be the maximum gain while the maximum loss is 29 with breakevens at 7,429, 7,771. This short strangle will work if the market stays range-bound.

The current short-term and medium-term trends are indeterminate. The long-term trend is bullish, of course. The intermediate trend appears to be going sideways. There is support at Nifty 7,450-7,500 and also at 7,550 zone. There is strong resistance at 7,650-7,700. The index is bouncing between these levels.

A breakout to a new all-time high above 7,700 or a drop below 7,450 could help to define the short-term trend. While there's support at every 50-points, a fall below 7,450 could mean a drop to 7,300 or lower.

Apart from Budget-related rumours, which are generally bullish in nature, volatility could be focussed on the energy sector. The Iraq situation is not going to be resolved quickly. This means crude prices (and to some extent, gas prices) will fluctuate with the fortunes of war. There will be high volatility across energy stocks. A poor start to the monsoon, with major rainfall deficiency also makes food inflation likely. This could put pressure on the financial sector.

Balancing negatives, there are strong expectations of reform on the oil subsidy front and also rumours of some reshuffling in the way the government maintains its control of public sector banks. At least until the budget, the rumours could keep the Bank Nifty afloat and also buoy up energy stocks. Selling pressure on the rupee can probably be managed without much trouble. A lower rupee could even be useful in that it would boost exports. The IT sector could perform its customary role as a hedge against a lower rupee.

Premia on the Nifty option chain is extremely high, reflecting expectations of high volatility. Open interest also implies that traders are braced for a move till either 6,900-7,000 or till 8,000-8,100 within the next 10 sessions. The put-call ratios (PCR) are bearish at around 0.9 PCR for both the July settlement and for the next three months.

A straddle at 7,600 (with spot Nifty at 7,612) is very expensive, costing 308, with 7,600c (170) and 7,600p (138). It is also skewed with puts much cheaper. A bullspread of long 7,700c (119) and short 7,800c (79) costs 40 and pays a maximum 60. This is expensive given distance from money. A bearspreasd of long 7,500p (99) and short 7,400p (67) costs 32 and pays 68. This is also expensive. Taking long strangles also look unprofitable. A trader might want to combine a short 7,700c, short 7,500p with a long 7,800c and long 7,400p. This receives 217 on short premium and pays 146 for the long positions. The net received of 71 would be the maximum gain while the maximum loss is 29 with breakevens at 7,429, 7,771. This short strangle will work if the market stays range-bound.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 30 2014 | 10:40 PM IST