National Board of Trade in dire straits

Exchange's business declines on members shifting to national platforms

)

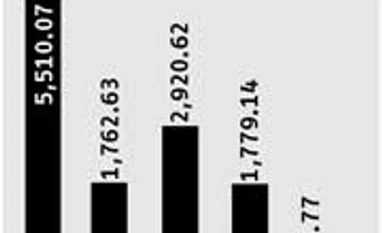

Struggling to control the exodus of its members, who are keen to join the more technologically-equipped national exchanges, the Indore-based National Board of Trade (NBoT) has recorded a sharp decline in business through the last five years. In May, NBoT's monthly turnover fell to a mere Rs 15.77 crore, compared with a staggering Rs 5,510.07 crore five years ago and a comfortable Rs 1,779.14 crore in the corresponding month last year.

Experts attribute the decline to a number of reasons. Through the last decade, the exchange has cut staff strength drastically. Also, the fact that members have shifted to national exchanges has led to lower volumes. “Our members are not keen on trading in NBoT. Therefore, they are switching to national exchanges. We tried our best to retain them but failed. What can we do beyond that?” asked Chairman Kailash Shahra.

When it was set up in 1999, NBoT was the benchmark exchange for refined soya oil, soybean and mustard seed. It was also the first exchange to approach the Forward Markets Commission (FMC) for approval to be converted into a national exchange, well before any national platform, including the Multi Commodity Exchange (MCX), the National Commodity & Derivatives Exchange (NCDEX) and the National Multi Commodity Exchange (NMCE), secured recognition.

However, the emergence of MCX, NCDEX and NMCE saw a radical transformation in futures trading. While traders had to be physically present in the exchange’s trading well for NBoT’s open-outcry bidding model, online trading facilitated other exchange members to trade from any part of the country. Also, the open-outcry bidding system had many loopholes, in terms of the authenticity of trade data.

Though the NBoT board had, on several occasions, met to restructure the trading system and upgrade it to an online one, differences among board members ensured there was no positive result. FMC had asked the exchange to meet its shareholding guidelines and apply afresh for conversion into a national level online platform.

But the exchange failed to achieve a consensus among its members on the issue. Consequently, traders started shifting to national platforms. From about 500 members a decade ago, membership has declined to about 50.Experts attribute the decline to a number of reasons. Through the last decade, the exchange has cut staff strength drastically. Also, the fact that members have shifted to national exchanges has led to lower volumes. “Our members are not keen on trading in NBoT. Therefore, they are switching to national exchanges. We tried our best to retain them but failed. What can we do beyond that?” asked Chairman Kailash Shahra.

When it was set up in 1999, NBoT was the benchmark exchange for refined soya oil, soybean and mustard seed. It was also the first exchange to approach the Forward Markets Commission (FMC) for approval to be converted into a national exchange, well before any national platform, including the Multi Commodity Exchange (MCX), the National Commodity & Derivatives Exchange (NCDEX) and the National Multi Commodity Exchange (NMCE), secured recognition.

However, the emergence of MCX, NCDEX and NMCE saw a radical transformation in futures trading. While traders had to be physically present in the exchange’s trading well for NBoT’s open-outcry bidding model, online trading facilitated other exchange members to trade from any part of the country. Also, the open-outcry bidding system had many loopholes, in terms of the authenticity of trade data.

Though the NBoT board had, on several occasions, met to restructure the trading system and upgrade it to an online one, differences among board members ensured there was no positive result. FMC had asked the exchange to meet its shareholding guidelines and apply afresh for conversion into a national level online platform.

“Once, we had planned to upgrade our technology as well, but this couldn't materialise due to lack of support from our members,” said Shahra, a veteran in the soybean trade The fact that his efforts to develop the exchange through the last several years have gone to waste irks Shahra.

Against several active contracts in soybean, refined soya oil and mustard seed earlier, the exchange is reduced to just one running contract in refined soya oil, with negligible volumes.

| On a free fall | |

| May | Turnover (in Rs crore) |

| 2013 | 15.77 |

| 2012 | 1,779.14 |

| 2011 | 2,920.62 |

| 2010 | 1,762.63 |

| 2009 | 5,510.07 |

| Source: FMC | |

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 25 2013 | 10:34 PM IST