Sebi might tweak essence of balanced funds

Could be defined as schemes with 50:50 equity-debt mix

)

premium

The Securities and Exchange Board of India’s (Sebi’s) proposed move to simplify category classifications of mutual fund schemes may lead to a change in the definition of balanced funds. The capital markets regulator has been going slow on approving balanced funds in the past few years and unofficially insisting on a 50:50 equity-to-debt mix for new scheme approvals. Currently, there is no standard definition of balanced funds.

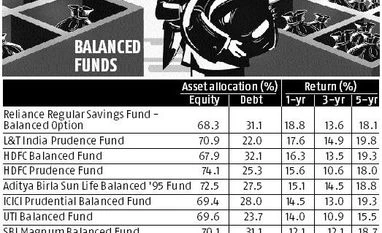

Several fund houses already offer balanced schemes that have an equity allocation of 65 per cent or higher. This allows them to be classified as equity schemes, which enjoy a tax advantage over debt funds as capital gains become tax free after a year. Since most diversified equity funds offer a 70-100 per cent equity exposure, the regulator believes a balanced fund offering 65-75 per cent does not offer much differentiation, according to sector officials.

Fund houses, on the other hand, have been reluctant to launch balanced schemes with a 50:50 mix, fearing the schemes will lose out on performance to older balanced schemes that have higher equity allocations.

“When you say something is a balanced fund, it has to be a truly balanced fund. We don’t want the investors to regret later that they went by the nomenclature and didn’t find the fund to be balanced at all,” G Mahalingam, whole-time member, Sebi, had said at a recent FICCI event.

Fund officials are worried that flows in the balanced category will migrate to the older balanced schemes with a higher equity allocation. “Within the industry, we have a caste system. So, if you came early and launched a balanced fund, you were given permission to launch multiple balanced funds. One could be a large-cap and one could be a mid-cap in which you could invest 90-95 per cent in equities. And, if you came late, you are told that only 50:50 debt-to-equity mix could be considered a balanced fund. It is important to create a level-playing field,” Kotak Mutual Fund Managing Director Nilesh Shah had said at a recent Business Standard event.

Several fund houses already offer balanced schemes that have an equity allocation of 65 per cent or higher. This allows them to be classified as equity schemes, which enjoy a tax advantage over debt funds as capital gains become tax free after a year. Since most diversified equity funds offer a 70-100 per cent equity exposure, the regulator believes a balanced fund offering 65-75 per cent does not offer much differentiation, according to sector officials.

Fund houses, on the other hand, have been reluctant to launch balanced schemes with a 50:50 mix, fearing the schemes will lose out on performance to older balanced schemes that have higher equity allocations.

“When you say something is a balanced fund, it has to be a truly balanced fund. We don’t want the investors to regret later that they went by the nomenclature and didn’t find the fund to be balanced at all,” G Mahalingam, whole-time member, Sebi, had said at a recent FICCI event.

Fund officials are worried that flows in the balanced category will migrate to the older balanced schemes with a higher equity allocation. “Within the industry, we have a caste system. So, if you came early and launched a balanced fund, you were given permission to launch multiple balanced funds. One could be a large-cap and one could be a mid-cap in which you could invest 90-95 per cent in equities. And, if you came late, you are told that only 50:50 debt-to-equity mix could be considered a balanced fund. It is important to create a level-playing field,” Kotak Mutual Fund Managing Director Nilesh Shah had said at a recent Business Standard event.