Will JSPL repay bondholders in April?

)

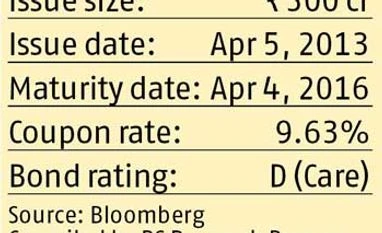

With another tranche of Jindal Steel & Power (JSPL) bonds amounting to Rs 300 crore coming for redemption on April 4, fund houses are worried whether they will get repaid. Over the past month, Franklin Templeton sold its entire JSPL bond holding of Rs 1,800 crore at a discount, in two tranches.

Easier delisting for small firms

The Securities and Exchange Board of India (Sebi) is expected to announce more leeway for smaller companies, particularly the ones that were listed on regional stock exchanges which are now defunct. Sources say exit could be in the form of buyback offers or might even be decided on a case-to-case basis. Securities lawyers recently met the market regulator to suggest more exit options in such companies, besides the existing delisting route. Even under the latter, Sebi is likely to do away with the requirement for reverse book-building, a price-discovery mechanism.

Merger blues for a fund house

A recently merged fund house is facing an unusual problem. While merging similar debt schemes of the two fund houses, a fund manager refused to transfer papers of a particular company into the merged scheme. The reason: The company had been rolling over its repayment for quite some time. Sectoral sources say the fund manager has been adamant about the decision. Last heard, the management had expressed its displeasure to the manager.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 21 2016 | 12:20 AM IST