Home / Finance / Personal Finance / Business interruption policy may not pay for losses made under lockdown

Business interruption policy may not pay for losses made under lockdown

Compensation will, however, be paid if a director covered by a Keyman insurance policy loses his life to Covid-19

)

premium

The BI policy comes with an exclusion that says BI loss shall not be payable if it is caused due to any restriction on operations imposed by public authorities

5 min read Last Updated : May 18 2020 | 2:20 AM IST

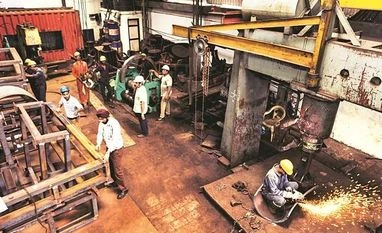

Amit Aggarwal (name changed on request), 47, runs a garment manufacturing unit in Noida. To protect his establishment, he has purchased a property/fire insurance cover. Bundled within his policy is what’s called a business interruption (or BI, also called ‘loss of profit’) cover. His unit has come to a standstill owing to the lockdown. Aggarwal is keen to know if the BI cover will compensate him for his losses.

A bundled cover: General insurers offer the BI cover to commercial establishments like restaurants, shops, factories, etc. This cover comes bundled with a property/fire policy. The latter provides protection against loss or damage due to events like fire, flood, cyclone, earthquake, riots, etc.

Will Covid-19 be covered? Those belonging to the general insurance industry say there will not be a pay-out. The BI cover, they say, comes with the ‘material damage’ proviso. It means no BI claim will be admissible unless there is a material damage claim caused by an ‘insured peril’. “If a claim is admissible under the property policy, say, there is a fire or flood and that causes a business interruption, then the claim under the BI policy gets triggered,” says C R Mohan, senior vice president and national head-property & risk engineering services, Bajaj Allianz General Insurance.

Mohan explains that pay-outs cannot be made due to two reasons. “While businesses have been interrupted, there has been no property damage. And even if there has been property damage, it is not due to an insured peril. Covid-19 is not a covered peril under this policy,” he says.

Subrata Mondal, executive vice president, IFFCO Tokyo General Insurance, also holds the same view. “Unless there is actual physical damage to the property due to an insured peril, the business interruption cover will not trigger,” he says.

Some legal experts, too, agree. “As things stand currently, business interruption is usually only attributable to accidental physical loss or destruction or damage to property and would not cover the impact of Covid-19 on business interruption per se,” says Aparajit Bhattacharya, partner, DSK Legal.

Experts at consultancy firms say businessmen will be compensated only if they have bought a separate pandemic cover. “Pandemic is a separate cover which needs to be bought, and likewise for damage due to mould and fungi – both of which are very rarely bought as customers economise on their insurance premium,” says Joydeep K Roy, partner and leader–insurance, PwC India.

The BI policy comes with an exclusion that says BI loss shall not be payable if it is caused due to any restriction on operations imposed by public authorities (as has happened in the present case). Moreover, very few commercial establishments in India actually possess the BI cover—less than 0.1 per cent of those who buy a property policy also buy the BI cover. The premium for a standard fire policy is 0.015-0.50 per cent of the insured value, depending on the nature of the goods and products secured. An equivalent rate is charged for the BI cover due to fire and allied perils.

The bottom line, according to legal experts, is to look at the fine print of your policy document. “If ‘loss of profit’ is one of the insurable interests under the policy and the event insured against is ‘occurrence of a pandemic’, only then will the insurance holder get a pay-out,” says Jayashree Parihar, senior associate, PSL Advocates & Solicitors.

The SARS precedent: The Severe Acute Respiratory Syndrome (SARS) pandemic started in February 2003. Sources say no pay-outs happened then either. “In India, as far as I am aware, no pay-out happened because no pandemic cover was available,” says Tarun Mathur, chief business officer, general insurance, Policybazaar.com.

After SARS, general insurers, in fact, tightened their policies. “By mid-April 2004 the SARS exclusion was issued almost universally. They inserted communicable-disease exclusions to prevent potential losses from the virus in the future. This might affect the present Covid-19 situation, if such an exclusion is mentioned in the policy,” says Parihar.

Will force majeure apply? This clause in a contract lists the circumstances under which it may become impossible for one or both the parties to fulfil the contract. The force majeure clause frees both the parties from their contractual obligations. Says Mondal: “Both the insurance regulator and the General Insurance Council (GIC) have issued clarifications in this regard. Just being a force majeure is not enough. The material damage provision also needs to be fulfilled.”

Disputes cannot be ruled out: Experts do, however, anticipate legal disputes over this issue. “There is likely to be considerable debate regarding whether the lockdown caused due to Covid-19 amounts to physical damage. Policies rarely define what is meant by physical damage. In such a case, all sorts of common law cases and principles are going to be debated in courts,” says Bhattacharya.

Keyman insurance will be triggered: Even if there is no payout under the BI cover, a commercial establishment could receive compensation under Keyman insurance. “If a company has purchased Keyman insurance for its directors, and one of them passes away due to Covid-19, then a fixed amount will get paid,” says Mathur.

Topics : Coronavirus