Here are few meaningful ways to leave a bigger legacy for your heirs

Invest in passive investment products that don't require regular evaluation

)

premium

graph

When an individual wants to leave a legacy for his grandchildren, usually, he buys a life insurance policy or invests in a fixed deposit in the name of the minor. Only a few focus on creating a legacy portfolio that can be passed to their children and grandchildren. Typically, the family wealth that the next generation inherits includes properties and what is left of the retirement corpus. But with a little planning, you can leave a much bigger corpus for the next generations.

Instead of investing a lump sum in the name of each child or grandchild individually, a person can create an investment portfolio by investing in a mix of asset classes. “An individual can choose simple long-term assets that don’t require a regular evaluation of the portfolio. As such portfolios will continue for decades, the compounding will ensure that you leave a meaningful corpus for the next generation,” says Malhar Majumder, a partner at wealth management firm Positive Vibes Consulting and Advisory.

If your portfolio grows at six per cent annually, an initial investment of Rs 1 million can become Rs 4.3 million in 25 years. At 8 per cent annual return, the portfolio will grow to Rs 6.8 million over the same period.

A trust for a larger corpus: A trust is the best vehicle for passing assets on to the next generation if they are significant. “It leaves no scope for disputes among beneficiaries, as is common in the case of a Will. It ring-fences assets. Lenders cannot attach assets that are placed in a trust,” says Arnav Pandya, certified financial planner

A trust, however, is a rigid structure. Once formed it’s difficult to change. Winding it up is cumbersome. You need to, therefore, be clear on the assets that you want to include in a trust, and the beneficiaries. You can write an investment policy statement that outlines the general investment goals, objectives, and describes the strategies that should be employed. You can take the help of a fee-only investment advisor who would charge anywhere between Rs 20,000 and Rs 45,000 as a one-time payment. To set up a trust, lawyers charge around Rs 25,000. Once floated, you will need to spend around Rs 15,000-20,000 annually to maintain it. The recurring cost includes compliance-related expenditure and chartered accountant's fee for maintaining the account and filing annual returns. “For those with limited assets, a Will can be sufficient,” says Suresh Sadagopan, founder, Ladder7 Financial Advisories.

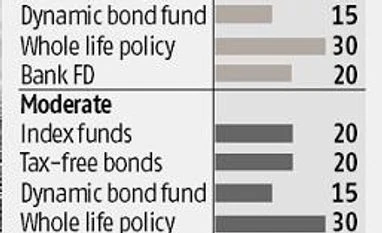

Safety is the key objective: Most people start thinking about leaving a legacy in their fifties or after retirement. The aim is to pass on a meaningful corpus to the next generation. By then capital preservation has already become their primary focus. The investments that you make in a legacy portfolio need to be long-term and should align with the tenure of your goal. If you are 55, and your life expectancy is 85 years, your goal is 30 years away. An investor needs to choose products that do not require active management.

Instead of investing a lump sum in the name of each child or grandchild individually, a person can create an investment portfolio by investing in a mix of asset classes. “An individual can choose simple long-term assets that don’t require a regular evaluation of the portfolio. As such portfolios will continue for decades, the compounding will ensure that you leave a meaningful corpus for the next generation,” says Malhar Majumder, a partner at wealth management firm Positive Vibes Consulting and Advisory.

If your portfolio grows at six per cent annually, an initial investment of Rs 1 million can become Rs 4.3 million in 25 years. At 8 per cent annual return, the portfolio will grow to Rs 6.8 million over the same period.

A trust for a larger corpus: A trust is the best vehicle for passing assets on to the next generation if they are significant. “It leaves no scope for disputes among beneficiaries, as is common in the case of a Will. It ring-fences assets. Lenders cannot attach assets that are placed in a trust,” says Arnav Pandya, certified financial planner

A trust, however, is a rigid structure. Once formed it’s difficult to change. Winding it up is cumbersome. You need to, therefore, be clear on the assets that you want to include in a trust, and the beneficiaries. You can write an investment policy statement that outlines the general investment goals, objectives, and describes the strategies that should be employed. You can take the help of a fee-only investment advisor who would charge anywhere between Rs 20,000 and Rs 45,000 as a one-time payment. To set up a trust, lawyers charge around Rs 25,000. Once floated, you will need to spend around Rs 15,000-20,000 annually to maintain it. The recurring cost includes compliance-related expenditure and chartered accountant's fee for maintaining the account and filing annual returns. “For those with limited assets, a Will can be sufficient,” says Suresh Sadagopan, founder, Ladder7 Financial Advisories.

Safety is the key objective: Most people start thinking about leaving a legacy in their fifties or after retirement. The aim is to pass on a meaningful corpus to the next generation. By then capital preservation has already become their primary focus. The investments that you make in a legacy portfolio need to be long-term and should align with the tenure of your goal. If you are 55, and your life expectancy is 85 years, your goal is 30 years away. An investor needs to choose products that do not require active management.