Investors better off in active funds than ETFs

Due to the falling alpha of large-cap funds, some fund houses have started reducing their expense ratios in that category to counter passive funds

)

premium

Source: Ace MF

With the launch of Bharat 22 Exchange-Traded Fund (ETF), the expense ratio of ETFs has touched a new low of 0.0095 per cent. This has revived the debate on active versus passive mutual funds (MFs) and whether it’s time for investors to look at such low-cost ETFs. The money that an investor saves in fees helps him in increasing returns on investments. Experts say investors would be better off sticking to active funds for now.

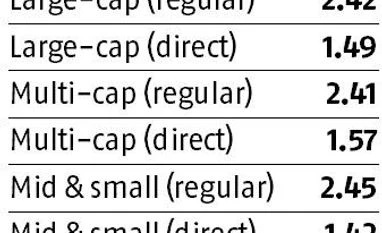

Today there are 19 ETFs with an expense ratio of 10 basis points (bps) or less. In contrast, the average expense ratio of diversified equity funds is 2.42 per cent for regular plans and 1.50 per cent for direct plans (see table). Meanwhile, the extra returns that a fund makes over its benchmark, called alpha, have been coming down in large-cap schemes. “From over eight percentage point a decade ago, large-cap funds now have an alpha of just three percentage point,” says Kaustubh Belapurkar, director of fund research at Morningstar Investment Adviser India.

Today there are 19 ETFs with an expense ratio of 10 basis points (bps) or less. In contrast, the average expense ratio of diversified equity funds is 2.42 per cent for regular plans and 1.50 per cent for direct plans (see table). Meanwhile, the extra returns that a fund makes over its benchmark, called alpha, have been coming down in large-cap schemes. “From over eight percentage point a decade ago, large-cap funds now have an alpha of just three percentage point,” says Kaustubh Belapurkar, director of fund research at Morningstar Investment Adviser India.

Source: Ace MF