Nuvama increases Bajaj Consumer target to ₹307 on GST boost, growth revival

Nuvama maintained a 'Buy' rating, underpinned by expectations of a revival in consumption and strategic focus on core categories.

)

A major catalyst, analysts believe, for the revised target is the recent GST cut. Bajaj Consumer’s portfolio, except coconut oil, has shifted from the 18 per cent to 5 per cent GST slab, considerably boosting affordability.

Listen to This Article

Nuvama on Bajaj Consumer: Domestic brokerage Nuvama has raised its target price for Bajaj Consumer Care stock to ₹307 from the earlier ₹291, on the back of strong medium-term growth prospects, margin expansion, and favourable GST reforms.

The brokerage maintained a ‘Buy’ rating on the Bajaj Consumer Care share, underpinned by expectations of a revival in consumption and strategic focus on core categories.

“Overall, we reckon consumption shall revive due to good monsoon, soft inflation and affordability due to GST reductions (moving from non-consumption to entry-level consumption); maintain ‘Buy’ with a revised target price (TP) of ₹307 (earlier ₹291),” said Abneesh Roy, Jainam Gosar, Shlok Mehta and Anchal Jain of Nuvama, in a note dated September 30, 2025.

The positive outlook of the brokerage follows a recent meeting with Naveen Pandey, the newly appointed managing director of Bajaj Consumer. With over 25 years of experience across global FMCG majors such as PepsiCo, Asian Paints, Marico, and Unibic, Pandey is spearheading a growth strategy centered on the company’s flagship hair oil portfolio, Almond Drops Hair Oil (ADHO). The management targets double-digit revenue growth and mid-to-high single-digit volume growth in ADHO over the next five years.

Margins are a key focus area. Bajaj Consumer’s Ebitda margin stood at 13.2 per cent in FY25, well below historical peaks of 30 per cent. The company now aims to achieve early-twenties Ebitda margins, aligning with industry standards. Margin expansion will be driven by mix improvement, better pricing realisation, and strategic adjustments in grammage levels, which are expected to revert to 2018 levels. Marketing spend will remain steady, but the share of ADHO within overall A&P is set to rise by 50 basis points, reflecting a sharper focus on the core portfolio.

Also Read

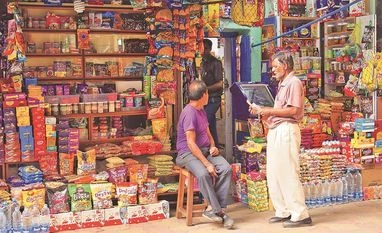

A major catalyst, analysts believe, for the revised target is the recent GST cut. Bajaj Consumer’s portfolio, except coconut oil, has shifted from the 18 per cent to 5 per cent GST slab, considerably boosting affordability. With strong penetration in ₹1-2 packs and plans to expand into ₹10-20 packs, the company is well-positioned to capitalise on the extended shelf-life and relevance of these packs over the next 5-8 years. Nuvama notes that lower GST will particularly benefit bottom-of-the-pyramid consumers, encouraging first-time purchases and driving incremental consumption.

According to analysts, the macro backdrop is also supportive. A good monsoon, softening inflation, and rising disposable incomes are expected to boost consumption in staples and personal care categories, particularly in rural and semi-urban regions. Distribution effectiveness is projected to improve from 0.5x to 0.7-0.8x, narrowing the gap with larger competitors, while penetration in southern markets is set to rise following the Banjara acquisition, they added.

In the hair oil market, which is worth ~₹17,500 crore with 20 per cent-plus Ebitda margins, Bajaj Consumer currently holds an 8 per cent market share, trailing the category leader Marico at ~30 per cent. The ADHO portfolio maintains a 1.8 price index relative to Parachute, underscoring its strong value proposition in the Hindi-speaking belt.

On valuation, Nuvama has rolled forward to FY28E earnings per share (EPS) and values the stock at 19x, after cutting FY26/27 EPS by 7-10 per cent due to lower other income post-buyback. Overall, the combination of GST tailwinds, strategic portfolio expansion, and margin recovery underpins Nuvama’s upward revision in target price and sustained bullish stance on Bajaj Consumer.

More From This Section

Topics : Stock Analysis share market FMCG stocks FMCG sector BSE Sensex Bajaj Consumer Bajaj Consumer Care BSE NSE Indian equities MARKETS TODAY Markets Sensex Nifty

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 01 2025 | 8:17 AM IST