Market Wrap, March 18: Sensex tanks 1,710 pts, below 29K; Nifty at 8,469

Market Wrap, March 18: Sensex tanks 1,710 pts, below 29K; Nifty at 8,469

The relentless selling on Dalal Street continued on Wednesday with no signs of abating as stocks across-the-board, especially financial sector, fell like a pack of cards

BS Web Team New Delhi

)

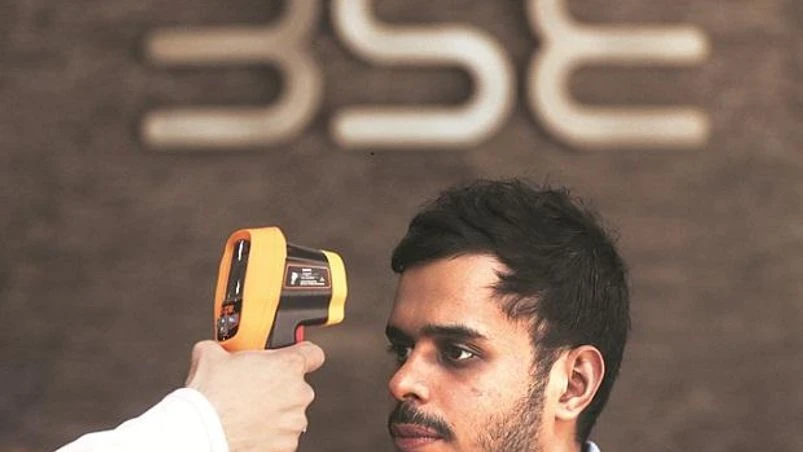

The relentless selling on Dalal Street continued on Wednesday with no signs of abating as stocks across-the-board, especially financial sector, fell like a pack of cards. Threat of economic fallout emananting from pandemic Coronavirus (Covid-19) continued to weigh on investor sentiment. Moreover, statements by global brokerages Morgan Stanley and Goldman Sachs that the coronavirus has triggered a global recession spooked investors further.

The S&P BSE Sensex sank 1,710 points or 5.6 per cent to end the day at 28,869.51. IndusInd Bank continued to bleed and ended at Rs 460 apiece, down 24 per cent. Other bluechip financial names such as HDFC Bank, HDFC, Bajaj Finance, and Axis Bank plunged up to 11 per cent. Investors lost around Rs 5.39 trillion today. In the past three days, they have lost Rs 15.1 trillion.

Of 30 constituents, 28 declined and only two - ONGC and ITC ended in the green. ONGC witnessed a phenomenal rise in the fag-end of the session and closed 10 per cent higher at Rs 66 apiece.

On the NSE, the benchmark Nifty breached 8,500 level to end at 8,469 points with 44 constituents declining and just 6 advancing. Sectorally, all but Nifty Media ended in the red. Nifty Media ended at 1,158, up 4.50 points or 0.39 per cent. Nifty Private Bank index tumbled 7 per cent to 11,219 while Nifty Bank slid around 6 per cent to 20,854 levels.

Also Read

In the broader market, the Nifty Midcap 100 index declined 5.5 per cent to 12,614 and the Nifty SmallCap index closed the day at 4,020 down over 6 per cent.

Global Markets

US stock futures and several Asian shares fell in choppy trade on Wednesday, as worries about the coronavirus pandemic eclipsed hopes broad policy support would combat the economic fallout of the outbreak. In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.3 per cent, led by a 4.9 per cent fall in Australia while Japan’s Nikkei gained 1.6 per cent. US stock futures fell 3 per cent in Asia.

European stock index futures fell more than 5 per cent as fears over the relentless global spread of the coronavirus.

In commodities, oil prices fell for a third session to be down about 17 per cent so far this week as the outlook for fuel demand darkened amid travel and social lockdowns triggered by the coronavirus epidemic.

Read by: Sukanya Roy

Read by: Sukanya Roy

More From This Section

Topics :MARKET WRAP

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 18 2020 | 4:59 PM IST