ITC: Volume recovery in cigarettes, scaling up of FMCG biz are positives

ITC is looking to replicate its success in the branded wheat segment, where it leads with a 28 per cent market share, by launching new products/foraying into new segments

)

premium

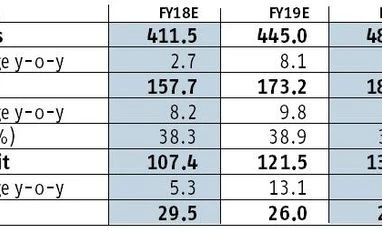

E: Estimates | Source: Nirmal Bang Institutional Equities

Traction for its fast moving consumer goods (FMCG) portfolio led by new launches, receding threat of higher taxation on cigarettes as well as attractive valuations are expected to lead to a rerating of the ITC stock. Analysts expect both the non-tobacco businesses as well as cigarettes to clock good volume growth as well as improved profitability in FY19.

Among the key triggers is the new product diversification and growth of its existing FMCG portfolio, which has in a short span of time resulted in three large brands comprising Aashirvaad, which recently crossed the Rs 40 billion mark, Sunfeast (a Rs 30 billion brand) and Bingo, Yipee, Classmate with sales of more than Rs 10 billion each. Though FMCG also includes personal care, lifestyle retailing, safety matches and incense sticks, the company’s significant success in the packaged foods segment is keeping investors excited. ITC is among the top two in branded wheat flour, cream biscuits, snack food and noodles categories. Among other sub-segments within the packaged food, it is present in the premium chocolates under the Fabelle brand, Coffee under Sunbean in addition to its juices brand B Natural.

Going ahead, ITC is looking to replicate its success in the branded wheat segment, where it leads with a 28 per cent market share, by launching new products/foraying into new segments under the umbrella of the flagship Aashirvaad brand. One such would be the liquid milk segment, where it already markets valued-added products such as Aashirvaad Svasti ghee and has recently launched milk pouch in Bihar. ITC will gradually scale up its presence in the milk pouch space, estimated at Rs 720 billion.

The other is the branded rice segment. While it is currently exporting rice, the launch at the end of the current year will mark its first foray into the domestic market in the Rs 220 billion branded rice market.

Given the existing base and the launch of new products, the company is hoping to more than double its revenues from the Aashirvaad brand to Rs 100 billion over the next five years. In the biscuit business, the company is expected to do well given its focus in the mid to premium segments, which is growing faster as compared to the value segment, resulting in higher market share. What should help add to the growth is an expansion of its distribution network comprising 2.7 million outlets? Post the implementation of the goods and services tax (GST), ITC would be a major beneficiary of a shift in consumption pattern from unorganised to organised segment and the supply chain. Moreover, demand, especially rural is recovering.

Margin gains for the FMCG major

Among the key triggers is the new product diversification and growth of its existing FMCG portfolio, which has in a short span of time resulted in three large brands comprising Aashirvaad, which recently crossed the Rs 40 billion mark, Sunfeast (a Rs 30 billion brand) and Bingo, Yipee, Classmate with sales of more than Rs 10 billion each. Though FMCG also includes personal care, lifestyle retailing, safety matches and incense sticks, the company’s significant success in the packaged foods segment is keeping investors excited. ITC is among the top two in branded wheat flour, cream biscuits, snack food and noodles categories. Among other sub-segments within the packaged food, it is present in the premium chocolates under the Fabelle brand, Coffee under Sunbean in addition to its juices brand B Natural.

Going ahead, ITC is looking to replicate its success in the branded wheat segment, where it leads with a 28 per cent market share, by launching new products/foraying into new segments under the umbrella of the flagship Aashirvaad brand. One such would be the liquid milk segment, where it already markets valued-added products such as Aashirvaad Svasti ghee and has recently launched milk pouch in Bihar. ITC will gradually scale up its presence in the milk pouch space, estimated at Rs 720 billion.

The other is the branded rice segment. While it is currently exporting rice, the launch at the end of the current year will mark its first foray into the domestic market in the Rs 220 billion branded rice market.

Given the existing base and the launch of new products, the company is hoping to more than double its revenues from the Aashirvaad brand to Rs 100 billion over the next five years. In the biscuit business, the company is expected to do well given its focus in the mid to premium segments, which is growing faster as compared to the value segment, resulting in higher market share. What should help add to the growth is an expansion of its distribution network comprising 2.7 million outlets? Post the implementation of the goods and services tax (GST), ITC would be a major beneficiary of a shift in consumption pattern from unorganised to organised segment and the supply chain. Moreover, demand, especially rural is recovering.

Margin gains for the FMCG major

E: Estimates | Source: Nirmal Bang Institutional Equities