From 11% to 2.2%, inflation does a Vanishing act in India

The slide has prompted the RBI to slash its inflation forecasts

)

premium

Four years ago, India’s inflation was running at over 11 per cent. Now it’s melted to a record low of 2.2 per cent, below Mexico, Turkey and the UK, as the Reserve Bank of India’s (RBI’s) battle against price pressures gains traction.

The slide has prompted the RBI, led by Urjit Patel, to slash its inflation forecasts and led one member of its six-person monetary policy committee to break ranks at its June 7 announcement, stoking market speculation the bank could next cut rates, perhaps as early as August.

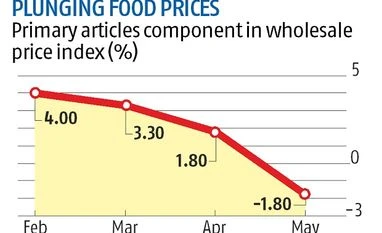

So what has changed? Economists say cyclical or temporary issues like a stronger currency and weaker domestic demand, combined with structural factors such as better food management by Prime Minister Narendra Modi’s government are in play.

There are risks the cyclical factors could easily unwind, but for now, economists increasingly see structural factors winning out. Inflation is expected to hug the lower band of the RBI’s two per cent to 3.5 per cent forecast for the first half of the financial year, ending in March and remain below the 3.5 per cent to 4.5 per cent target for the second half.

The slide has prompted the RBI, led by Urjit Patel, to slash its inflation forecasts and led one member of its six-person monetary policy committee to break ranks at its June 7 announcement, stoking market speculation the bank could next cut rates, perhaps as early as August.

So what has changed? Economists say cyclical or temporary issues like a stronger currency and weaker domestic demand, combined with structural factors such as better food management by Prime Minister Narendra Modi’s government are in play.

There are risks the cyclical factors could easily unwind, but for now, economists increasingly see structural factors winning out. Inflation is expected to hug the lower band of the RBI’s two per cent to 3.5 per cent forecast for the first half of the financial year, ending in March and remain below the 3.5 per cent to 4.5 per cent target for the second half.