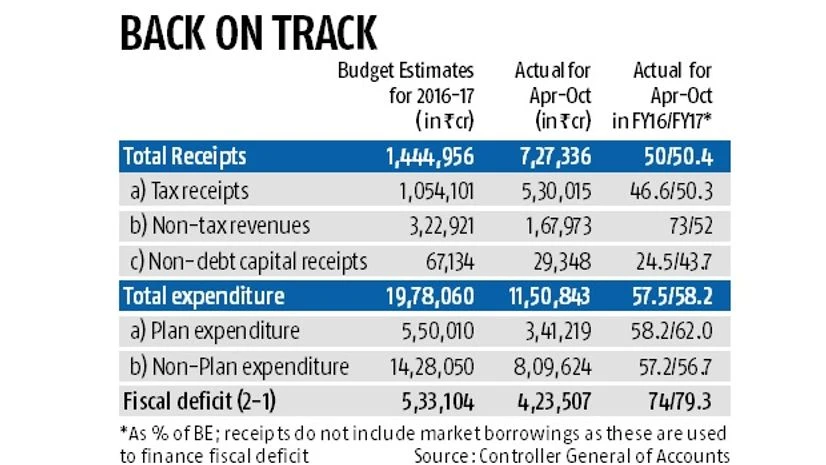

The Centre’s fiscal deficit for the seven-month period of April-October stood at Rs 4.23 lakh crore, or 79.3 per cent of the full-year target, official data showed on Wednesday. This is on the back of a rise in indirect taxes and non-debt capital receipts, especially divestment.

With the availability of July-September quarter’s gross domestic product data, it has now emerged that April-September fiscal deficit stood at 6.3 per cent of the GDP, compared with a full-year target of 3.5 per cent.

Additionally, October was a good month for the Centre’s finances in that it showed a fiscal surplus. The April-September fiscal deficit was nearly 84 per cent of the full-year target of Rs 5.34 lakh crore.

For April-October last year, the fiscal deficit had stood at 74 per cent of budgeted estimates.

According to the data released by the Controller General of Accounts, tax revenue came in at Rs 5.30 lakh crore, or 50.3 per cent of the full-year budgeted estimates of Rs 10,54,101 crore. This was a big jump month-on-month as the number stood at 41.2 per cent of the target in September.

“Indirect taxes have picked up and we expect that the trend to continue for the rest of the year,” said a senior government policymaker.

Tax revenue was at 50.3 per cent of the full-year budgeted estimates at October-end compared with 42.5 per cent at September-end. Non-tax revenue was at 52 per cent at the end of October compared with 37 per cent at end-September. For the same timelines, non-debt capital receipts were at 43.7 per cent compared to 19.1 per cent.

The government’s Plan expenditure during the April-October period came in at Rs 3.41 lakh core, 62 per cent of the full-year estimates. The non-Plan expenditure during April-October of 2016-17 was Rs 8.09 lakh crore, or 56.7 per cent, of the whole-year estimate.

The total expenditure (Plan and non-Plan) was Rs 11.50 lakh crore against the government's estimate for the current financial year at Rs 19.78 lakh crore.

The revenue deficit during the seven months stood at Rs 3.27 lakh crore, or 92.6 per cent of the Budget estimate for 2016-17.

)