The Reserve Bank of India (RBI) has pulled up lenders for keeping interest rates on loans at a higher level and said it would make another system to fix rates for such loans.

The banking regulator expressed concern over base rate and marginal cost of funds-based lending rate (MCLR) and said these internal benchmarks have not improved monetary transmission. A new system using external benchmarks to price loans would be introduced, the RBI said.

In its report, an internal RBI study group to review the working of the MCLR system has suggested switching over to the new system in a time-bound manner so that better rates are available to borrowers.

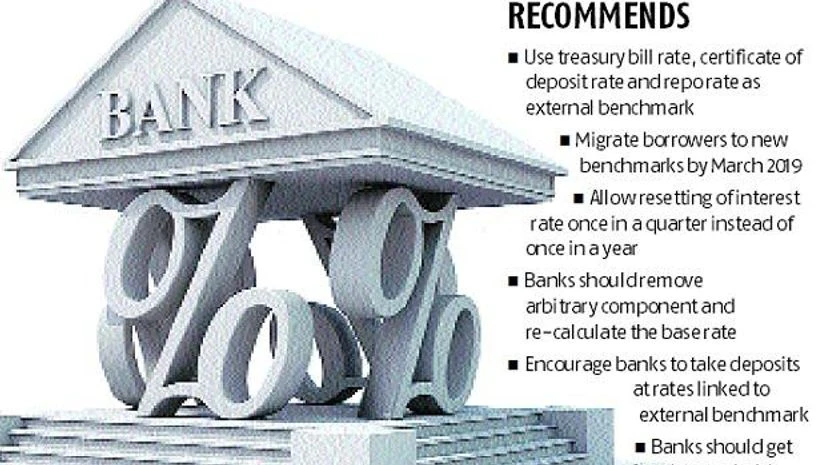

The report said banks should use three benchmarks — treasury bill rate, certificate of deposit rate and RBI’s policy repo rate — for pricing loans. Against the current system of annual reset of interest rates, the panel recommended quarterly reset. All borrowers should be migrated to the new system by March 2019 without a switchover fee.

Banks would also have the freedom to decide on the spread over the external benchmark, and the spread would remain fixed through the term of the loan, the report said. Even deposits would be linked to one of the three benchmarks.

The study group observed that internal benchmarks such as the base rate/MCLR have not delivered effective transmission of the monetary policy. It also found that banks were deviating from the specified methodologies to calculate rates. This was being done to inflate the rate and prevent it from falling in line with the cost of funds. Banks did not reduce rates even as the cost of deposits declined significantly. The panel also found that banks included new components in the base rate formula to adjust the rate to a desired level. The slow transmission to the base rate loan portfolio was further accentuated by the long (annual) reset periods.

The RBI had introduced MCLR on April 1, 2016, after finding the then prevailing base rate had failed to achieve the objectives of easier and faster policy transmission. Before the MCLR was rolled out, banks were following a more rigid base rate system, which came into force on July 1, 2010, replacing banks’ prime lending rate.

According to RBI data for commercial banks, the median one-year MCLR has come down from 9.45 per cent in April 2016 to 8.50 per cent in August 2017.

The banking industry lobby group, the Indian Banks’ Association (IBA), said in a statement a review of existing MCLR framework and the proposal for an external benchmark was something to be discussed with the stakeholders. IBA, however, refrained from making a specific comment.

The base rate/MCLR regime is also not in sync with global practices on pricing of bank loans.

Addressing the media after the policy review, RBI Deputy Governor Viral Acharya said the report has proposed three possible external benchmarks to which such lending could be tied. “We think internal benchmarks such as the base rate and MCLR, based on data, seem to give banks very high amount of discretion; lots of factors are flexible to them to ensure that the lending rate can be kept high even if monetary policy is going down and accommodative.”

He also said the move was to bring in a better global benchmark. “This will create a fair bit of transparency for borrowers and they can just compare two loans and see which is at the lower spread because the benchmark will be the same.”

)