Regulator rationalises card transaction fee

Volume and value of debit card transactions has only grown by 12 and 14% after demonetisation

)

premium

Last Updated : Dec 07 2017 | 6:15 PM IST

In a bid to boost digital payments in the country, the Reserve Bank of India (RBI) has cut the merchant discount rates (MDRs) for debit card transactions at point-of-sale (POS) terminals and also put a cap on the absolute rate.

“The revised MDR aims at achieving the twin objectives of increased usage of debit cards and ensuring sustainability of the business for the entities involved,” the RBI said on Wednesday, in its Statement on Developmental and Regulatory Policies.

MDR is the rate charged to a merchant by a bank for providing debit and credit card services. Effective January 2018, MDR will be determined based on merchant turnover, instead of the value of transaction. The maximum rate for merchants with yearly turnover below Rs 2 lakh is 0.4 per cent, capped at Rs 200 per transaction. The MDR limit for merchants with yearly turnover exceeding Rs 2 lakh is 0.9 per cent, capped at Rs 1,000 per transaction. The differential rating system will encourage small and medium enterprises to accept debit card payments.

The RBI has also pushed the use of QR (quick response) code-based transactions by keeping the MDR limit for asset light card acceptance at 10 basis points lower than those of the physical POS.

“The previous system of ad valorem rate continues, but the slab system has been done away with. We have gone by the merchant category way, which will be very simple to administer,” said B P Kanungo, deputy governor, RBI, at the monetary policy press conference.

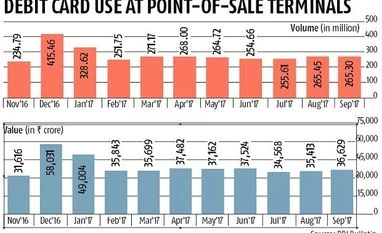

While volume and value of debit card transactions has only grown by 12 and 14 per cent after demonetisation, the number of POS terminals almost doubled from 1.5 million in November last year to 2.9 million in September 2017.

“Category-based MDR rates will make payments more inclusive. With the passing of this circular, it will provide more clarity to the base served by the payment infrastructure providers. This should spur payment innovation for smaller merchants and help drive QR-based payments,” said Dewang Neralla, co-chair, Merchant Aggregator and Acquirer Committee of Payment Council of India, and chief executive of Atom Technologies. The RBI had released a draft circular in February, revising MDR for small merchants, special merchants as well as government transactions. However, the recent circular has no mention of any such distinction.

Deepak Chandnani, managing director, South Asia and Middle, Worldline, said, “There has to be fair sharing of fees between card issuers and merchant acquirers. For physical POS infrastructure, MDR should be at least 25 basis points, and for asset light quick response (QR)-code, it should be above 15 basis points to make activity viable.”

There is no limit on MDR for credit card transactions. “India is a debt-oriented country; we have more debit cards than credit cards. And credit cards are usually associated with the risk of customers defaulting,” said Neralla.