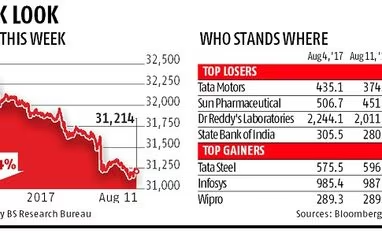

Markets post worst weekly performance in 18 months

Benchmarks fall 1% each, taking weekly decline to 5%; analysts expect volatility to continue

)

premium

graph

Continuing tension between the US and North Korea weighed down Indian equity markets as the benchmarks closed more than 1 per cent lower. While the Sensex lost 317 points, or 1 per cent, to close at 31,213, the Nifty gave up the crucial 9,800 mark to close at 9,710, down 109 points, or 1.1 per cent. This is the fifth straight session of declines for the Indian benchmarks, making it the worst weekly performance since February 2016. During the week, the Sensex fell a little over 5 per cent, data showed.