Govt to address stress in banks

On goods & services tax bill he Said left to myself, I will continue to persuade the Congress even though the numbers are in our favour

)

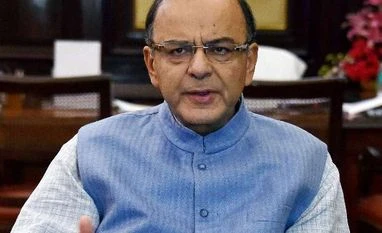

Union Minister for Finance Arun Jaitley interacts with the media on the volatility of the share market in New Delhi. Photo: PTI

The government is in the process of addressing the 'twin balance sheet' problem of companies and state-run banks, Finance Minister Arun Jaitley said in Sydney on Tuesday.

On a four-day visit to Australia to attract foreign direct investment (FDI), Jaitley said the government has opened up various sectors, including insurance and railways, and removed unnecessary conditions to encourage FDI flow.

"We are addressing the issue of stretched balance sheets by recapitalising the banks, addressing the sectors which have caused stress," said Jaitley. He added India could grow at eight per cent in the next couple of years.

Also Read

"Despite a global slowdown, we have managed to maintain 7.5 per cent growth rate. All our parameters, including the current account deficit, are very acceptable figures. I am reasonably certain that as the global push to the economy slightly improves - hopefully, we'll have a better monsoon - these figures could look even better in the days to come," Jaitley said.

On ease of doing business, the finance minister said India has been moving forward in eliminating corruption in decision-making, regarding projects and environment, and Foreign Investment Promotion Board clearances.

On taxation, Jaitley said the Indian government had resolved various legacy issues and was gradually working to bring down the corporate tax rates to the global level at 25 per cent from 30 per cent.

"One of the more important areas had been to bring India's taxation system compatible with global standards. Therefore, we are now working on direct tax systems, where we want to put the disputes behind us."

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 30 2016 | 12:18 AM IST