October's industrial output decline could be an aberration

Surge in non-oil, non-gold imports, auto sales data suggest there could be growth in Nov

)

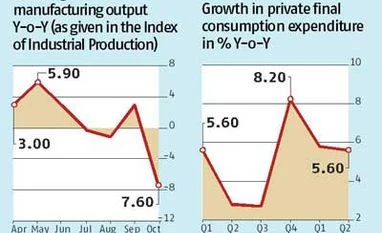

A sharp 7.6 per cent drop in India’s manufacturing production in October puzzled many. But that could be an aberration, and the country’s industrial production, a major portion of which is factory output, could see a growth in November from 4.2 per cent fall in October.

Some of the recently released data seem to suggest the same. According to trade numbers released on Monday, India’s non-oil, non-gold imports, a pointer to industrial demand, in November rose 27.7 per cent to $27.5 billion from $20 billion in the same month a year ago. By comparison, these had increased only 5.6 per cent in October (to $22.91 billion from $21.7 billion last year).

Besides, there was a pick-up in automobile sales in November, indicating an increase in production during the month. Domestic car sales in November increased 9.5 per cent over a year ago, compared with declines in the two previous months.

Economists, however, warn growth might not be too high to begin with; it could rise gradually. They cite a sudden drop in consumption demand as one of the main reasons for a manufacturing decline. It is unusual for demand to be this weak during the festival season.

Growth in private consumption expenditure, a proxy for consumption demand in the economy, did not decline much in the September quarter and stood at 5.64 per cent, higher than the 5.81 per cent in the previous quarter. The growth rates in both quarters, though, were much lower than the 8.22 per cent in the March quarter of last financial year.

Some of the recently released data seem to suggest the same. According to trade numbers released on Monday, India’s non-oil, non-gold imports, a pointer to industrial demand, in November rose 27.7 per cent to $27.5 billion from $20 billion in the same month a year ago. By comparison, these had increased only 5.6 per cent in October (to $22.91 billion from $21.7 billion last year).

Besides, there was a pick-up in automobile sales in November, indicating an increase in production during the month. Domestic car sales in November increased 9.5 per cent over a year ago, compared with declines in the two previous months.

Economists, however, warn growth might not be too high to begin with; it could rise gradually. They cite a sudden drop in consumption demand as one of the main reasons for a manufacturing decline. It is unusual for demand to be this weak during the festival season.

Growth in private consumption expenditure, a proxy for consumption demand in the economy, did not decline much in the September quarter and stood at 5.64 per cent, higher than the 5.81 per cent in the previous quarter. The growth rates in both quarters, though, were much lower than the 8.22 per cent in the March quarter of last financial year.

“Though industrial output growth numbers do not show a clear trend on a monthly basis, the fact that a significant contraction came in a month considered the beginning of the festival season indicates consumption demand is still weak and fragile,” said India Ratings’ Sunil Kumar Sinha.

He agreed low demand was not something that would occur for only one month — during festival season — and then pick up the next month. But he was quick to add that rural demand, which now forms a major portion of India’s total demand, was affected by low kharif output. According to the government’s first advance estimates, foodgrain production in 2014-15 is expected to be around 120.27 million tonnes, around nine million tonnes less than the previous year. In fact, the impact on rural income was also seen in the motorcycle segment, which registered a sales decline of 3.05 per cent in November, even as other automobile segments registered sales growth.

Urban demand, too, has not picked up much. But how could demand crash suddenly in a festival month? Sinha explained demand in October did not necessarily reflect the dispatches that left factories that month. Much of the October demand might have been met by production in earlier months.

“I am not gung ho about the November numbers. Manufacturing production and the larger IIP might rise due to a low base effect. But the base was low in October as well. November might see growth but it will not be phenomenal,” said Madan Sabhnavis, chief economist, CARE Ratings.

State Bank of India chief economic adviser Soumya Kanti Ghosh said he was bit skeptical now. November IIP might record a growth, but it would not be much. Recovery could start from Decmeber onwards, he added.

Sabnavis said demand in the economy remained low. Whatever extra money came from harvests in October was largely spent on gold. This was substantiated in high numbers for gold imports in the month. In fact, gold imports rose phenomenally in November as well.

India’s gold imports rose 280.1 per cent to $4.2 billion in October, against $1.2 billion in the same month a year ago. In November this year, these imports were up 571 per cent to $5.6 billion from $0.8 billion last year.

One possible reason for a sudden drop in industrial production in October could be the presence of a large number of holidays during the month. This time, both Diwali and Dussehra, apart from a number of regional holidays, fell in October. This meant fewer working hours for factories. Even in pre-2008 years, whenever these two main festivals have fallen in the same month, the industrial production story has been somewhat similar to this year’s. However, the difference was that a deceleration in monthly growth was not played up in those years because industrial output was on the rise. By comparison, since production in the secondary sector was crawling to pick up this year, a contraction in October was hard to miss.

“Whenever there is contraction, the issue is hotly debated. Also, expectations are high this time because there is a new government at the helm of affairs,” Sinha said.Among other factors cited for an output drop was the closing down of Nokia’s Chennai factory. But does one factory stopping production leads to a 7.6 per cent drop in manufacturing output? A finance ministry official thought so. He said contraction in manufacturing was largely due to the shutdown of a major factory rendering many unemployed.

The ‘radio, TV and communication equipment & apparatus’ segment, under which the Nokia factory’s production is categorised, saw a 70 per cent plunge in output during October. With a 0.98 per cent weight in manufacturing, that would imply a contraction of 0.68 per cent in overall industrial production. But a little less than seven per cent of the drop in manufacturing production is still not accounted for.

Besides, even as the Nokia plant’s production had begun to thin from October, a complete shutdown happened only on November 1.

“The Nokia factor might have contributed to a fall in manufacturing output but that fact should not be overstated. Of the 22 industry groups, 16 witnessed contraction,” Sabhnavis said.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 17 2014 | 12:48 AM IST