RBI might cut repo 25 bps this month: BS Poll

)

With the US Federal Reserve deciding to keep interest rates unchanged, quite a few feel the stage is set for Reserve Bank of India to reduce the repo rate by at least 25 basis points in the next monetary policy review.

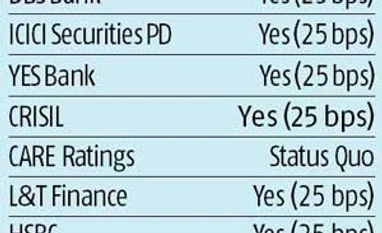

According to a Business Standard poll of 10 experts, nine felt the central bank would cut the rate by 25 bps in the review slated for September 29.

Bankers and economists said three conditions set by RBI in the earlier review for a further cut had largely been met. Benign inflation (including that of food), sufficient transmission of the policy rate and spread of a normal/excess monsoon over 64 per cent of the country's area was ground enough, they said.

The US Fed's decision to keep policy rates on hold also provided room for easing those in India, they added.

RBI has reduced the repo rate by 75 bps since January, to 7.25 per cent.

State Bank of India head Arundhati Bhattacharya said there is space for a rate cut but how much is difficult to state at this point. The pressure on food prices in the coming months could ease, which gives room for RBI, she said.

Rupa Rege Nitsure, group chief economist, L&T Financial Services, said even if RBI cut the repo by 25 bps, "I expect the statement to be hawkish. This might be the last rate cut in this financial year, as there are upside risks to inflation once the base effect wanes."

Adding: "Though the kharif sowing is fine, the yield will be a problem, given the unevenness in the distribution of rain. There might be price spikes due to that. The services sector still enjoys better pricing than manufacturing. The Consumer Price Index (CPI) has higher weightage on services than manufacturing."

The CPI reading for August was a 3.66 per cent rise, compared with 3.69 per cent in July. RBI has set an inflation target of less than six per cent by January 2016 and four per cent (+/-two per cent) by the end of the two years starting 2016-17.

Another cut by RBI, for pushing growth, will further build pressure on banks to pass on the benefit to borrowers.

Since January, most banks have reduced their base rate, benchmark for pricing of loans, only by 25-30 bps.

According to a Business Standard poll of 10 experts, nine felt the central bank would cut the rate by 25 bps in the review slated for September 29.

Bankers and economists said three conditions set by RBI in the earlier review for a further cut had largely been met. Benign inflation (including that of food), sufficient transmission of the policy rate and spread of a normal/excess monsoon over 64 per cent of the country's area was ground enough, they said.

The US Fed's decision to keep policy rates on hold also provided room for easing those in India, they added.

State Bank of India head Arundhati Bhattacharya said there is space for a rate cut but how much is difficult to state at this point. The pressure on food prices in the coming months could ease, which gives room for RBI, she said.

Rupa Rege Nitsure, group chief economist, L&T Financial Services, said even if RBI cut the repo by 25 bps, "I expect the statement to be hawkish. This might be the last rate cut in this financial year, as there are upside risks to inflation once the base effect wanes."

Adding: "Though the kharif sowing is fine, the yield will be a problem, given the unevenness in the distribution of rain. There might be price spikes due to that. The services sector still enjoys better pricing than manufacturing. The Consumer Price Index (CPI) has higher weightage on services than manufacturing."

The CPI reading for August was a 3.66 per cent rise, compared with 3.69 per cent in July. RBI has set an inflation target of less than six per cent by January 2016 and four per cent (+/-two per cent) by the end of the two years starting 2016-17.

Another cut by RBI, for pushing growth, will further build pressure on banks to pass on the benefit to borrowers.

Since January, most banks have reduced their base rate, benchmark for pricing of loans, only by 25-30 bps.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Sep 19 2015 | 12:29 AM IST