Earnings, tax worries trigger market correction

Benchmark Sensex falls 555 pts; Rs records year's steepest fall; FIIs pull out Rs 1,500 cr

)

Worries about corporate earnings and the impact of retrospective taxation on foreign investors rattled Indian equities and the rupee on Monday. While the benchmark equity indices dropped about two per cent, the rupee posted its worst single-day decline against the dollar this year. Fear of Greece exiting the euro zone and the vulnerability of financial markets to a stimulus rollback by the US Federal Reserve exacerbated the slide.

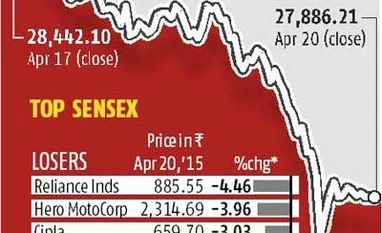

Declining for a fourth consecutive day, the benchmark Sensex ended 1.95 per cent, or 555.89 points, lower at 27,886.21, its lowest since March 27. The 50-share Nifty ended at 8,448.10, down 157.9 points, or 1.83 per cent, the most since March 26.

|

HEADWINDS Triggers that led to the Sensex losing about 1,100 points (4%) in the past four sessions |

|

Against Friday’s close of 62.37 a dollar, the rupee fell 0.9 per cent to 61.92 a dollar on Monday, the lowest since March 13. Foreign institutional investors (FIIs) pulled out about Rs 1,500 crore from Indian markets on Monday, provisional data provided by exchanges showed.

Worried about the Rs 40,000-crore minimum alternate tax demand by the government, FIIs net-sold shares for a fourth day. So far this year, FIIs, the biggest non-promoter shareholders in Indian companies, have pumped in about $6 billion.

“The market is facing a lot of uncertainty. March-quarter earnings are a worry; there are issues surrounding FII taxation, the land Bill and a US Fed rate rise. All these contributed to the correction,” said Raamdeo Agrawal, joint managing director, Motilal Oswal.

A poor start to the fourth-quarter earnings season led to panic among investors, brokers said. “Earnings disappointments in the first few results of the ongoing results season, against the already low expectations, could result in further correction,” said Sanjeev Prasad, senior executive director & co-head, Kotak Institutional Equities. Global events such as a possible exit of Greece from the euro zone, and tax notices to FIIs on past income were affecting investor sentiment, he added.

On Monday, the Reliance Industries Ltd stock fell 4.5 per cent, after its earnings failed to enthuse investors. Among the 30 Sensex components, only two — Sun Pharmaceutical and ICICI Bank — closed with gains. Hero MotoCorp, Cipla, Axis Bank and ITC were among the top losers.

In the past four trading sessions, the Sensex has declined about four per cent. The index, which had risen six per cent this month, is now trading marginally lower.

Agrawal said, “The market is undergoing a correction after a sharp rally; there is no reason to panic. It should consolidate till there is clarity on corporate earnings.”

Global investment bank UBS has reduced its year-end target for the Nifty by four per cent to 9,200. "The revised target reflects our view of the growth recovery being slower than expected, as is being played out in quarterly corporate results. It reflects the possibility of near-term consolidation and profit-taking, given the limited absolute upside from current levels in the near term," said Gautam Chhaochharia, head of India research, UBS.

Prasad said now, the market would focus on three key domestic factors - the ongoing results season, the government's ability to amend the land acquisition Bill in the second half of the Budget session of Parliament, and monsoon forecasts.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 21 2015 | 12:59 AM IST