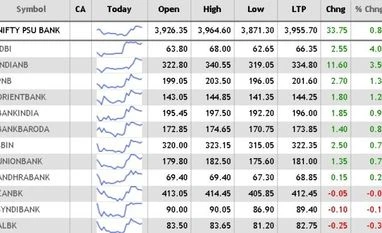

Sensex ends marginally lower, Nifty holds above 10,400; Nifty Pharma up 3%

All that happened in today's trade

)

Source: NSE

The Benchmark indices settled flat on Thursday after hitting new highs in Wednesday's trade as some company results including from Tech Mahindra, and JSW Energy disappointed investors, but gains in pharmaceutical shares lent some support.

The markets had hit record highs in the previous session, on continued optimism after the government’s recent decision to inject more funds into state-run lenders.

Overseas, European stocks were trading flat as investors waited for the latest rate decision from the Bank of England (BOE). Asian shares advanced after the US Federal Reserve expressed optimism about the US economy in its policy statement released overnight. The US Fed kept interest rates unchanged on the expected line, but its commentary on the US economy has virtually confirmed a December rate hike.

Meanwhile, the White House plans to nominate current Fed Governor Jerome Powell as the next chair when Janet Yellen’s term expires in February, a source familiar with the matter said on Wednesday. Powell’s nomination is expected later on Thursday and would need to be confirmed by the Senate.

3:46 PM

Vinod Nair, Head of Research, Geojit Financial Services

Market went through some profit-booking after touching the all time high. But the gradual change in FII inflows from negative to positive led by domestic cues will keep the India growth story intact. Pharma stocks emerged as a dark horse due to attractive valuations and expectation of faster USFDA approvals for plants. On the global front, Fed kept the rate on hold as expected, while rising optimism on economic development is adding more weights to a hike in the month of December which has largely been factored in the domestic market.

3:45 PM

Market wrap-up by Nikhil Kamath, Co-Founder and Head of Trading, Zerodha

Markets closed the session flat for the day; pharma stocks were the best performers for the session, Divi's Labs was the best performer, notching up gains of 17% for the session. Sun Pharma, Lupin, and Aurobindo Pharma were the best performers at the index level. Markets corrected slightly at the opening and then continued to trade rangebound in a very small range throughout the session.

Domestic institutions continue to remain flush with liquidity whereas FIIs continue selling. Overall, we are yet to see the level of bullishness and complacency which could signal the end of the inherent bull trend. This rally could have further legs in the short term; we would still not advocate taking fresh longs at this juncture.

3:42 PM

Sensex heatmap at close

Source: BSE

3:38 PM

Market breadth

The market breadth, indicating the overall health of the market, turned negative from positive. On BSE, 1,420 shares fell and 1,337 shares rose. A total of 142 shares were unchanged.

The market breadth, indicating the overall health of the market, turned negative from positive. On BSE, 1,420 shares fell and 1,337 shares rose. A total of 142 shares were unchanged.

3:37 PM

Broader markets underperform

The BSE Midcap and the BSE Smallcap indices settled 0.4% lower each.

The BSE Midcap and the BSE Smallcap indices settled 0.4% lower each.

3:36 PM

Markets at close

The S&P BSE Sensex ended at 33,573, down 27 points, while the broader Nifty50 was ruling at 10,423, down 16 points.

The S&P BSE Sensex ended at 33,573, down 27 points, while the broader Nifty50 was ruling at 10,423, down 16 points.

3:29 PM

Sectoral trend

Source: NSE

3:24 PM

Bitcoin crosses $7000

Bitcoin reached yet another all-time high, surpassing $7,000 for the first time ever, boosted by bets the cryptocurrency could enter the financial mainstream after the world's largest derivatives exchange operator said on Tuesday it would launch bitcoin futures.

3:19 PM

JSW Steel: Firm profit outlook will help sustain sentiment

JSW Steel may have seen a relatively soft September quarter but its prospects remain firm in light of the improving demand environment, as well as profitability and firm prices. READ FULL ANALYSIS

3:03 PM

HDFC Life IPO: From anchor investment to market share, all you need to know

HDFC Standard Life Insurance, one of the top three private life insurers in profitability, will open its Rs 8,700-crore initial public offering (IPO) next Tuesday and close it on Thursday. This will be the fourth IPO of an HDFC arm.

"The issue has been attractively priced for retail investors. I would say investors should not look for the first day pop and invest in the company with a long-term horizon for good returns,” said HDFC Life MD & CEO Amitabh Chaudhry in the company’s IPO roadshow in New Delhi on Wednesday. HDFC Life will get listed on stock exchanges on November 17.

Topics :

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 02 2017 | 3:34 PM IST