Sources told Business Standard that the additional Rs 2.5 billion was being funded by UltraTech Cement for a 98.43 per cent stake in Binani Cement and makes up for interest payment to the lenders from July 2017 to date. “The deal with UltraTech Cement is for finances to the tune of Rs 72.66 billion and any additional interest that needs to be paid to the creditors in Binani Cement,” the sources said.

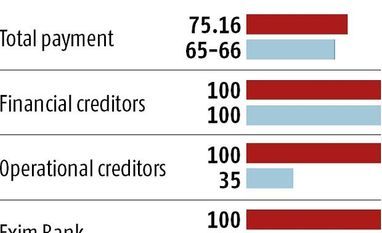

On Thursday, Binani Cement said an upfront payment of Rs 72.66 billion would be made to the lenders and an additional Rs 2.5 billion would be offered to clear all dues.

Under the process prescribed by the Insolvency and Bankruptcy Code (IBC), the creditors have already issued a letter of assurance to the Dalmia Bharat-led consortium, offering it control of Binani Cement for Rs 65-66 billion.

Previously, the lenders had insisted that if Binani Industries wanted to have discussions on the proposal it should repay full interest till day. The lenders also asked Binani Cement to deposit Rs 2.5 billion and issue a bank guarantee to prove “sincerity towards an out-of-court settlement”.

“Without any deposit with us, how can the creditors assume that Binani Industries will actually pay back the entire sum owed to the lenders once they are out of insolvency proceedings? Because of that, the creditors have asked Binani Cement to first deposit money with the lenders and then obtain clearance from the Supreme Court for an out-of-court settlement,” a lender to the bankrupt company said.

Legal sources close to Binani Cement, however, argued that Binani Industries would not be able to deposit any money with the lenders until the National Company Law Tribunal (NCLT) approved its out-of-court settlement offer.

Though Binani Cement has arranged for funds to pay back the creditors fully, through a deal with UltraTech Cement, lenders want “some sort of guarantee from Binani Cement”. This has turned out to be one of the major points of contention between Binani Industries and the lenders.

Lenders also fear that an out-of-court settlement with the promoters of the bankrupt company will result in breach of contract according to IBC rules, and they may face legal proceedings by Dalmia Bharat. The Kolkata Bench of the NCLT had suggested an out-of-court settlement considering the matter of maximisation of value.

The National Company Law Appellate Tribunal had later backed the NCLT’s view. Sanjeev Gemawat, executive director, legal, Dalmia Bharat, however, said: “The proposition of value maximisation cannot be heard in isolation. The court has suggested that the interest of various stakeholders needs to be looked into.”

)